Meridian raises $7M seed round led by 645 Ventures.

Read More

This in-depth comparison looks at features, use cases, pricing, and more of top 4Degrees competitors to help you make the best choice for your firm.

4Degrees tracks your firm’s communication patterns, identifies warm paths to targets, and simplifies portfolio management.

But as deal sourcing becomes increasingly data-driven, private equity professionals need more than simple relationship insights. Tools that help you source, evaluate, and close opportunities efficiently, without toggling between systems, are what you need to win.

Shopping for 4Degrees alternatives can pay off, if you know what to look for. This comparative guide reviews a list of four alternative solutions that can help you surface valuable opportunities before other firms.

Our top picks for 4Degrees alternatives:

4Degrees has carved out a reputation for customer relationship management, helping teams keep tabs on network connections using strength scoring to identify warm paths to targets. Plus, its email sync cuts down on the need for manual data entry.

All of that makes the platform a popular choice for deal teams that prioritize relationship tracking above all else. But those who want to source and close complex deals faster might find that it falls short.

The problem? Mapping relationships won’t necessarily equal optimized deal flow management, and 4Degrees’ limited sourcing capabilities means that you might end up leaving money on the table.

On top of these limitations, 4Degrees doesn’t offer many integrations beyond the basics. This can hurt adoption and result in you paying for a tool that no one on your team really uses.

For teams that want comprehensive AI-powered sourcing paired with relationship intelligence and private equity workflow automation, the need for 4Degrees alternative becomes obvious.

The right customer relationship management platform will help you at every step of the dealmaking process, from sourcing to contact management and closing. Below are four of the best private equity CRMs for building stronger pipelines and closing deals faster.

Focus Area: Complete AI-powered CRM for PE

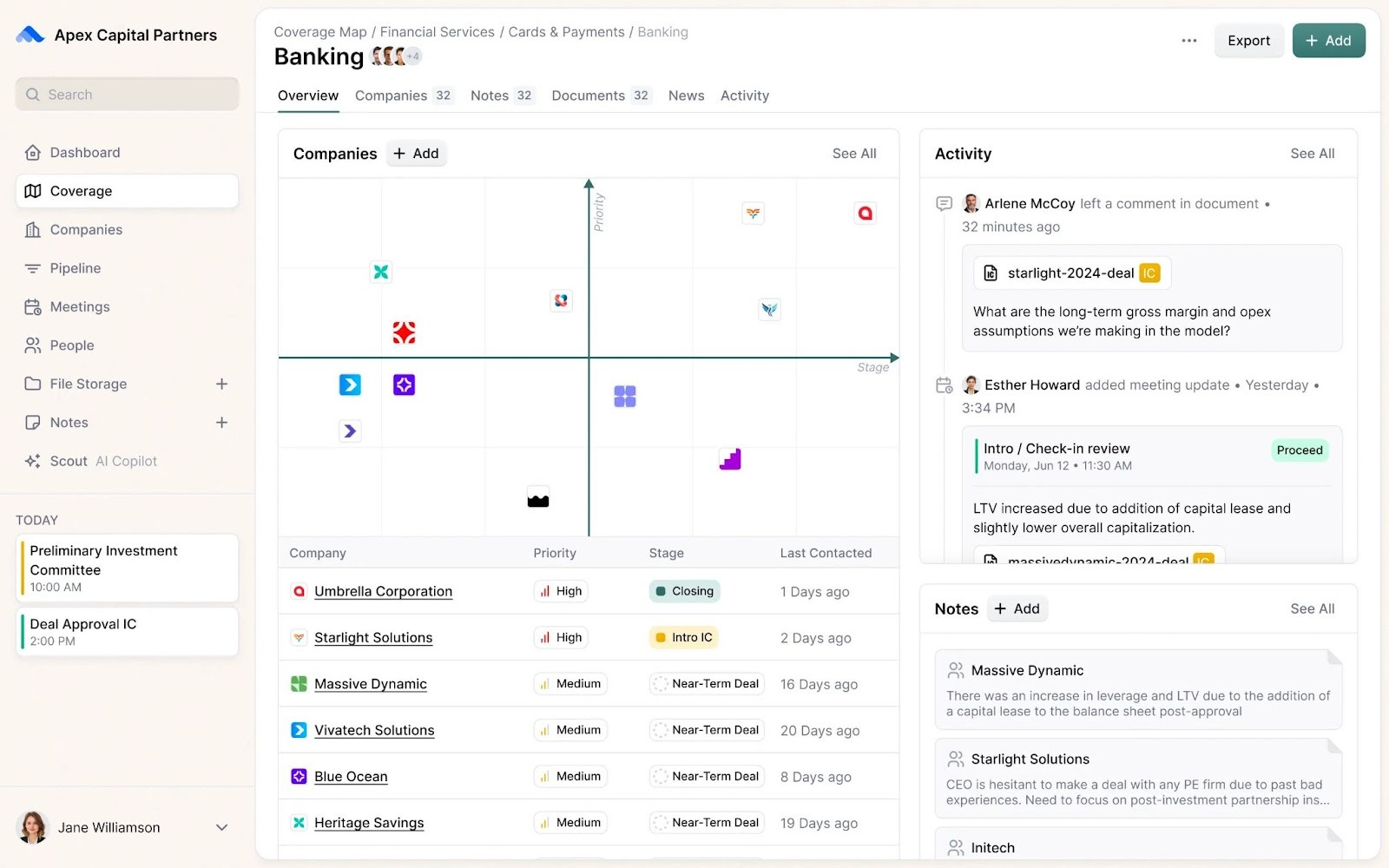

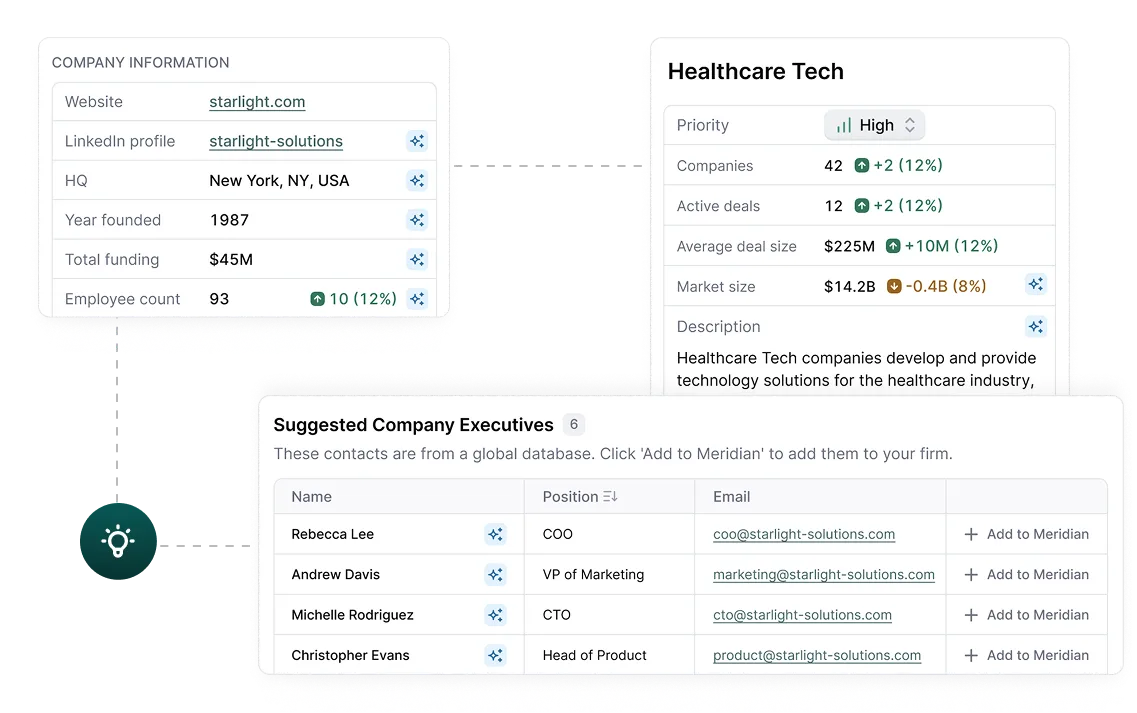

Meridian tackles the problem most legacy CRMs ignore: turning scattered documents into relationship intelligence resources at speed and at scale.

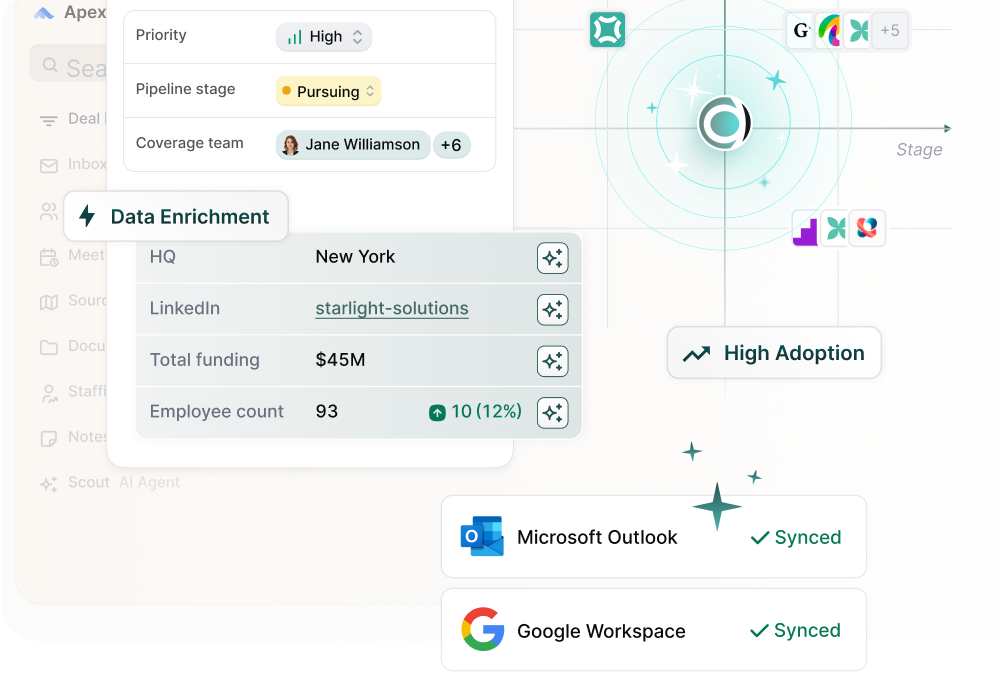

The platform combines relationship tracking with intelligent thematic sourcing. This unifies your firm’s proprietary data with external market intelligence so you can identify promising opportunities before competitors even know they exist.

Then Scout AI steps in: pulling key metrics from CIMs, auto-generating comps and memos, and benchmarking new targets against your firm’s past deals and broader market activity. That means your team spends less time buried in spreadsheets and more time evaluating opportunities that fit your thesis.

Meridian also integrates seamlessly with your tech stack. The Outlook integration makes tracking interactions easy, running in the background without plugins or constant maintenance. Emails sync automatically, calendar events attach to the right deals, and documents land where they belong.

And with 26M+ enriched company profiles built right into the platform, you’re working from a single source of truth instead of toggling between scattered spreadsheets and subscriptions.

4Degrees does a good job of tracking relationships, but it lacks the sourcing intelligence and IC workflow automation that firms need to close complex deals. Meridian’s CRM solution is designed to fit how PE teams actually work, and it integrates powerful sourcing, pipeline management, and IC features into one centralized platform.

From data enrichment and IC workflow automation to thematic sourcing and deal flow management, Meridian handles all your firm’s most important processes.

Focus Area: AI-powered deal intelligence for private capital

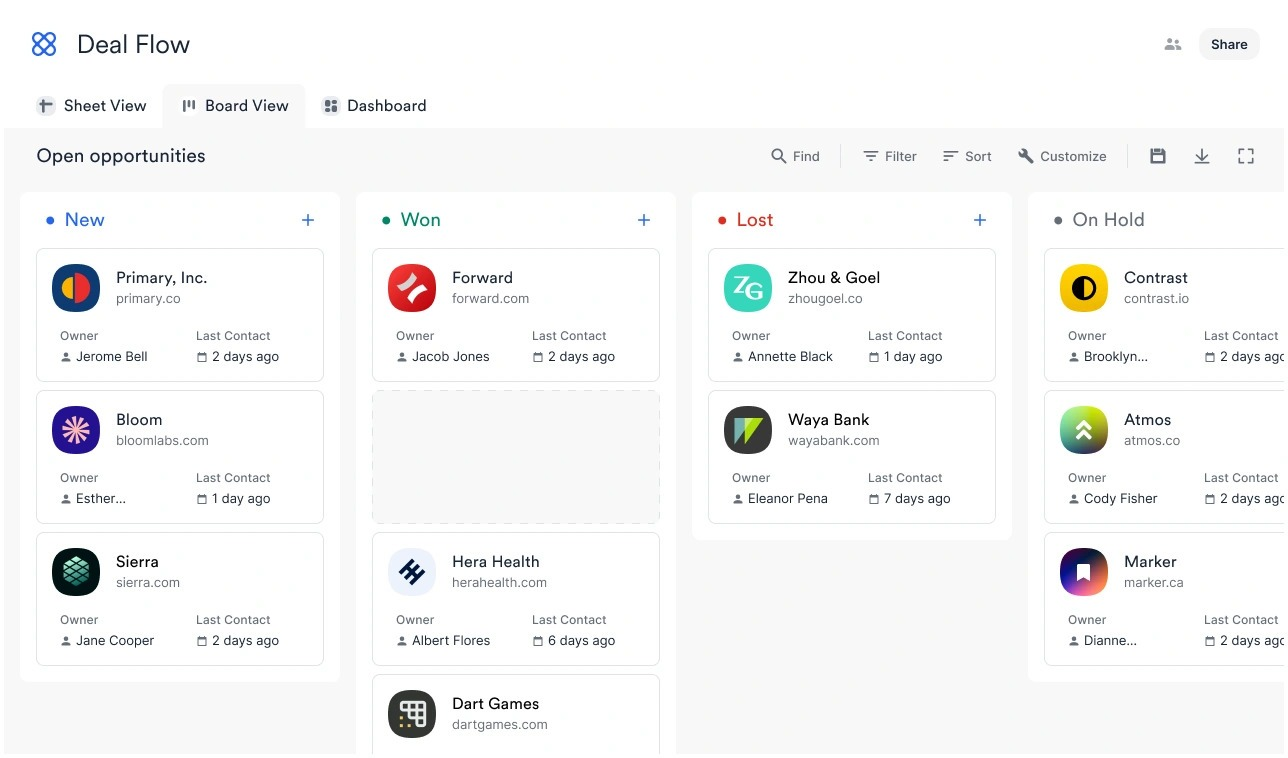

Affinity built its reputation on automated data capture and relationship mapping. The platform automatically syncs with your email and calendar to surface warm paths to decision-makers.

Customizable pipelines and flexible permissions controls help users manage confidential deal information, while integrations with Slack, Dropbox, Mailchimp, and other tools simplify the process of connecting with the rest of your tech stack.

It’s good at what it does, but Affinity lacks the sourcing intelligence and IC workflow automation that PE teams need for efficient deal flow.

Affinity's automatic data capture runs deeper than 4Degrees’ email sync, pulling richer context from data sources and scoring relationship strength more precisely.

Learn how Affinity compares to other competitors in our Affinity alternatives article, or see a side-by-side comparison of Meridian vs. Affinity.

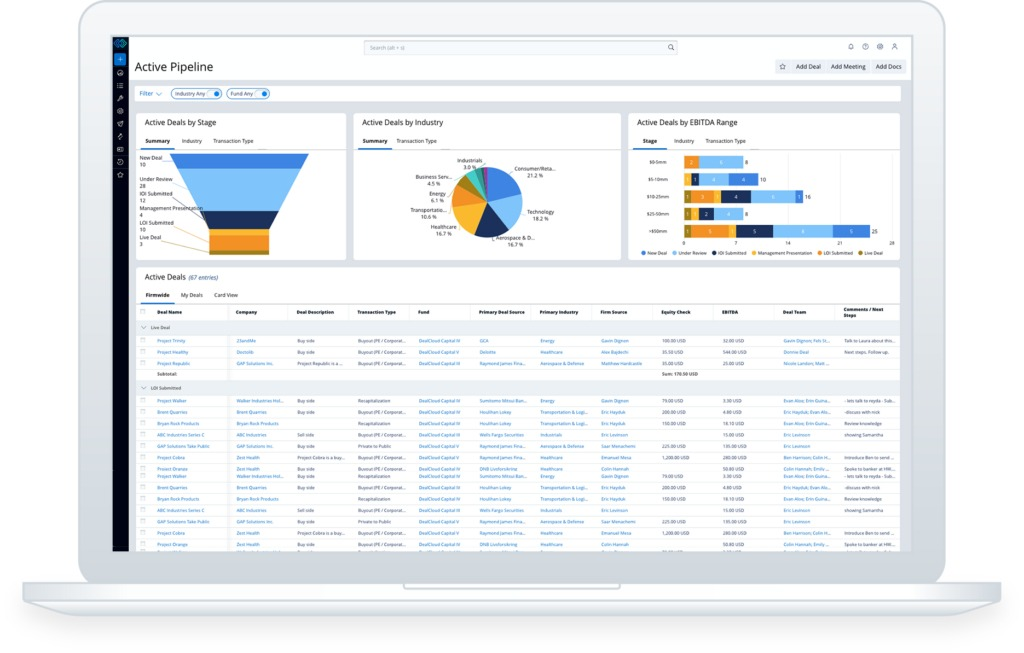

Focus Area: Deal and pipeline management for the financial services industry

DealCloud combines deal tracking, relationship management, and compliance tools in one system that works for larger teams in the private capital space. It’s a configurable platform that allows teams to tailor pipelines, dashboards, tearsheets, and reports to match their unique processes.

But that customization may come at a price. DealCloud’s team handles configurations, which can stretch implementation timelines to months and increase costs.

The hands-on approach does mean that the platform can be set up to handle complex organizational structures. Plus, it offers a range of compliance tools that are built specifically for SEC-registered portfolio companies.

DealCloud offers more extensive customization and enterprise-grade compliance features than 4Degrees, making it better suited for large, complex organizations with specialized workflow requirements.

Learn how DealCloud compares to other competitors in our DealCloud alternatives article, or see a side-by-side comparison of Meridian vs. DealCloud.

Focus Area: Salesforce-based CRM that’s customizable for private capital teams

Navatar layers its relationship management platform on top of Salesforce to transform the CRM from one that’s fit for sales teams to a tool that works for venture capital, private equity, commercial real estate, and investment banking firms.

It combines automation tools with customizable dashboards to give users a clear, real-time view of deals, pipelines, and investor relationships. And the platform leverages Salesforce’s Agentforce and Microsoft Copilot to surface real-time insights and recommendations natively within your existing workflow.

But you’re still working on top of Salesforce, which means you inherit both its power and its problems. The infrastructure is built for quick sales processes rather than tracking long-term relationships, and full customization often requires support from Salesforce or third-party consultants.

While 4Degrees excels at relationship intelligence, Navatar has a comprehensive suite of tools for deal-sourcing, investor relations, and portfolio workflows that automate data capture and deal management.

A CRM tailored for PE can turn scattered deal information into a unified source of truth. This gives your team the visibility, context, and agility they need to uncover better opportunities and drive lasting relationships.

When evaluating 4Degrees alternatives, look for tools designed specifically for PE that offer these key features:

The best CRMs for private equity aren’t deal databases with a fancy label slapped onto them. Firms need purpose-built software like Meridian that strengthens deal flow management, speeds up opportunity sourcing, and supports team collaboration.

Meridian’s PE relationship intelligence platform is designed to help teams move faster, see further, and make smarter investment decisions. It goes beyond relationship tracking to deliver true workflow intelligence, providing tools that unify sourcing, evaluation, and execution in one seamless system.

Plus, the AI-native design simplifies data entry to help teams track opportunities and close deals long before competitors even get a chance to notice that the window is open.

The best part? You can get the system implemented in just weeks, with a full data transformation that cleanses and enriches information while extracting structured data from old deal folders people haven’t touched in years.

Once it’s up and running, the platform works quietly in the background so your team can focus on execution rather than admin. This keeps your database 100% up to date with 10x less effort, making Meridian the top choice on any list of 4Degrees alternatives.

Discover how Meridian can streamline deal sourcing and enhance your decision-making

Meridian was built by and for PE professionals, providing tools that keep your firm strategic, efficient, and ahead of the game.

Table of Contents

Gain an in-depth understanding of private equity relationship management software so you can pick the tool that best fits your firm’s needs.