Meridian raises $7M seed round led by 645 Ventures.

Read More

Gain an in-depth understanding of private equity relationship management software so you can pick the tool that best fits your firm’s needs.

Relationship management software is built to help private equity firms nurture relationships over extended timelines, where deals unfold over multi-year cycles. In this industry, stakeholders constantly rotate, and you’re juggling founders, intermediaries, and LPs. Even the strongest networks can break without structure.

For example, imagine a company that goes up for sale feels strangely familiar. Turns out you know the founder and spoke with them a year ago. Somewhere along the way, the relationship quietly cooled before you could get in on the process, and instead of preempting the auction, you’re stuck in a bidding war.

Relationship management software prevents scenarios like this one. In this guide, we cover how relationship management works in private equity, the challenges firms face, what to look for in a purpose-built tool, and the platforms teams use to stay coordinated and source better deals.

In private equity, winning the best deals comes down to consistently maintaining deep, contextual relationships over long cycles. This breaks down fast when outreach becomes generic, fragmented, or transactional.

Private equity is a relationship business. You don’t land the best deals with cold outreach; you land them with the people you make connections with long before a process ever launches.

Managing relationships in the private equity space requires you to remember context over years, like what mattered to a CFO six months ago and which banker prefers a quick call versus a detailed memo. And you fail at the first hurdle if you send a canned message with no personalization or thought.

The value of the human connection is more important than ever, and firms are doing themselves a disservice when they rely on high-volume, transactional, and impersonal sourcing outreach.

Clunky processes, fragmented data, and limited visibility make it increasingly hard to maintain consistent, personalized engagement. This causes even strong relationships to quietly weaken, little by little.

That’s because building trust takes time, but keeping it takes consistency. You create strong connections through regular, thoughtful engagement over time: when you remember context, follow up at the right moments, and show up even though there’s no deal on the table.

But intentional relationship management takes serious effort. With the masses of information scattered across inboxes, spreadsheets, and team members, follow-ups slip through the cracks and outreach becomes generic.

Before you know it, all your communications start to sound the same, and you’re unable to meaningfully connect with the power players. Multiply that across hundreds or thousands of relationships and long deal cycles, and you’re leaving serious value on the table.

Here’s where most firms struggle:

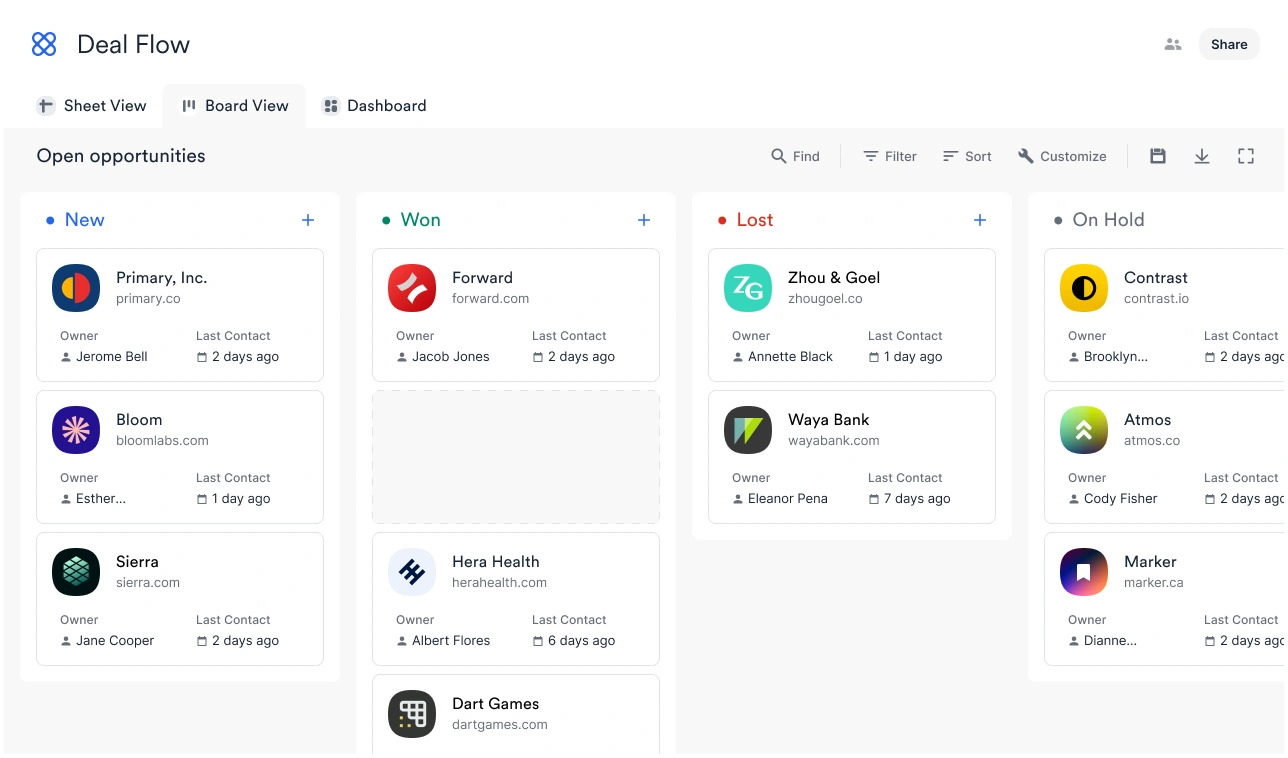

A modern customer relationship management (CRM) solution built for private equity turns day-to-day interactions into relationship intelligence the whole firm can use: capturing history automatically, preserving context across long deal cycles, and tracking relationships at scale.

Your firm can’t fully benefit from the relationships individual team members build if the knowledge about them lives in one person’s head or inbox. That means relationship intelligence isn’t shared, structured, or usable.

Partners build trust over years, VPs track conversations over months, and associates do their own follow-ups. But without a single source of truth, context fragments.

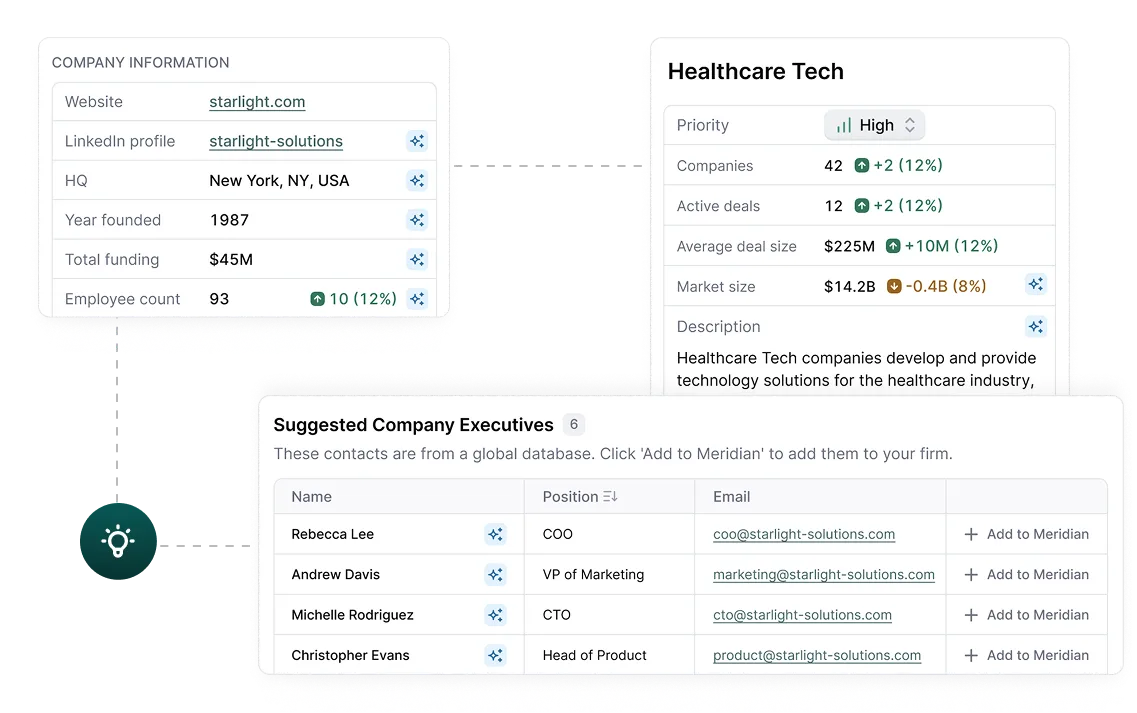

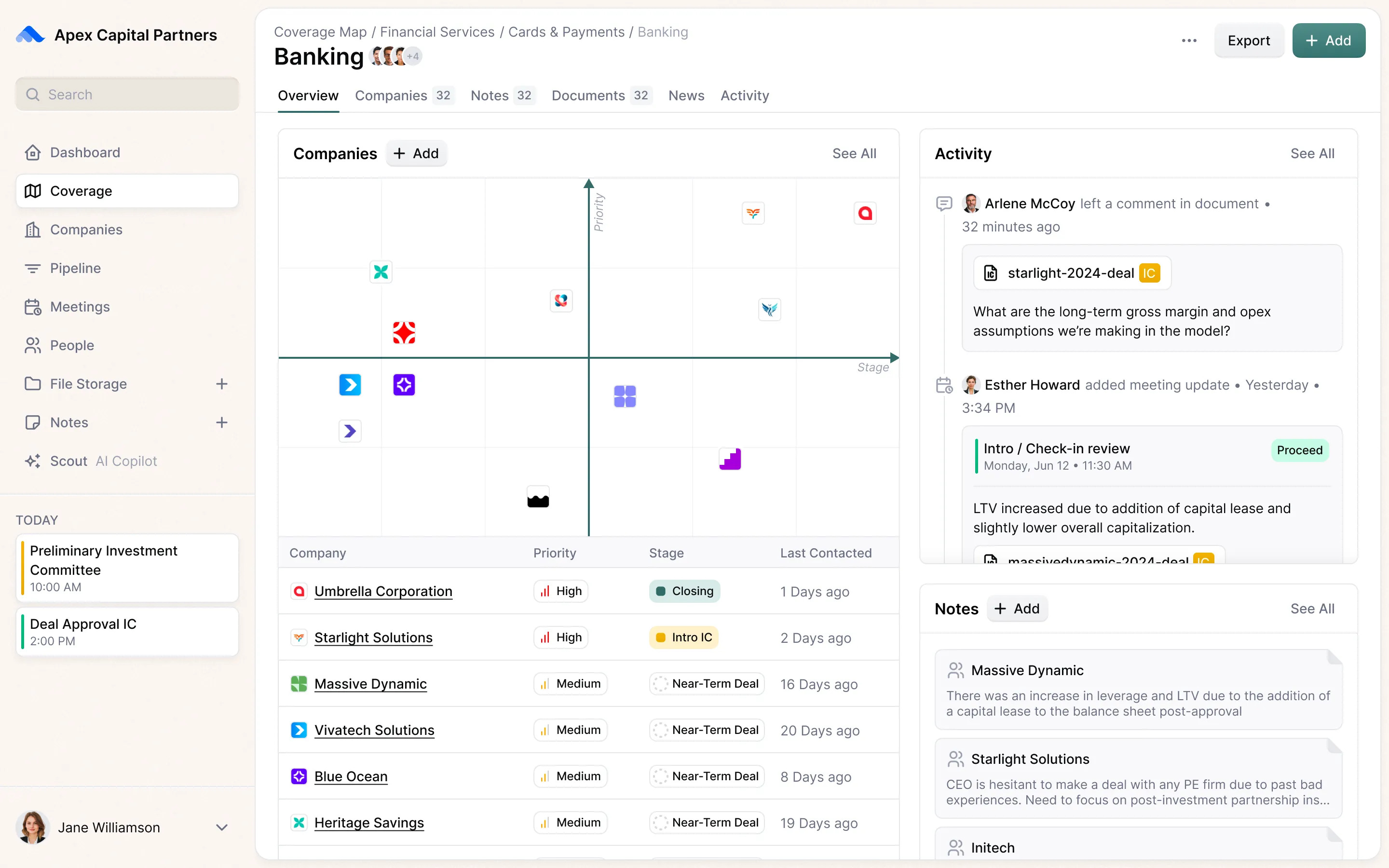

PE CRM Meridian, for example, serves as your ultimate context provider, helping you with that human touch. It becomes your single source of truth, which makes it easier to send more informed outreach, show up to meetings more prepared, and leave a lasting impression.

So instead of relying on memory or manual updates, teams get a clear picture of relationship strength, momentum, and risk. This changes how firms operate: coverage becomes coordinated and personalization becomes easier, making relationships become your institutional advantage.

PE firms need tools that track relationships across multi-year cycles, preserve context between touchpoints, and are useful long before (and after) a deal is in motion.

And when evaluating a private equity CRM vs standard CRM, the real difference shows up in how well the tool supports long, relationship-driven deals. Here’s what to keep in mind when researching and selecting a solution.

Relationship mapping helps PE firms see how people, companies, and intermediaries are connected.

Instead of treating contacts as isolated records, it maps your network of founders, management teams, bankers, advisors, and LPs, and how those connections evolve over time.

Context no longer lives only in individual memories or inboxes, making outreach more coordinated and preventing outreach duplication.

Teams can also use relationship mapping software components to coordinate outreach and engage through the strongest path rather than relying on guesswork or memory.

The result: In practice, this can change outcomes. For example, a partner preparing to engage a founder might discover that a principal already has a relationship through a board role or prior investment. The principal reaches out instead of the partner, and thanks to this connection, scores a meeting with the management team.

A senior associate picks up an account that hasn’t been touched in months. The last conversation happened on a call they weren’t part of, the follow-up lives in someone else’s inbox, and the nuance behind the relationship never made it into the CRM.

They send the outreach anyway. It’s polite, but generic. And the target never responds. That’s likely because the associate didn’t have the context they needed to personalize their message.

When capturing that context relies on manual updates, important details slip through the cracks and continuity breaks down.

CRM automation shifts that dynamic. Interactions are logged as they happen and tied back to the right people, companies, and deals. That way, context is preserved without adding extra admin.

The result: Automatic context capture makes it easier for anyone on the team to step in with a clear understanding of conversation history, tone, and momentum for more consistent, informed engagement.

Relationship context is only useful if it’s actually captured. And in private equity, administrative tasks are usually the first thing to fall away when deal activity picks up. Emails, meetings, and calls happen constantly, but too often the CRM lags behind what’s really happening.

One-click activity sync closes that gap by making updates effortless across multiple channels. Instead of needing teams to switch tools or carve out time for admin, activity is synced immediately and attached to the right contacts and companies.

That way, the system stays current without disrupting how people already work, and the payoff shows up quickly.

A VP preparing for a banker call can see specific data for recent touchpoints without chasing colleagues for updates, while a partner stepping into a conversation with a founder has instant visibility into what’s been discussed in previous meetings.

The result: Cleaner handovers, fewer missed signals, and far less reliance on memory to enable personalized outreach and strong relationship building, even during the busiest deal cycles.

How you get introduced matters just as much as what you say, and a warm path increases the odds that a conversation goes somewhere meaningful.

Firms do themselves a disservice by doing high-volume, transactional, impersonal sourcing outreach. If a business owner has two identical offers, they will typically go with the person they feel they have a better relationship with.

Relationship management software built for PE helps teams spot those paths quickly. By surfacing shared connections and past interactions across the firm, team members can see who already has credibility with a founder, banker, or LP, and they can pick the best route of approach.

The real advantage comes from pairing that visibility with detail. Nuanced context (anything from a target’s preferred communication style to whether they’re a Yankees or Mets fan) can be captured directly on contact records for teams to review before contact.

The result: Anyone on your team can reach out to connections with conversations that feel informed and personal. That’s what builds trust faster and moves relationships forward.

Banker and advisor tracking add structure to the complexity of managing intermediary relationships.

Instead of treating bankers as just another contact in your CRM, this feature captures how individuals and institutions connect to past deals, portfolio companies, failed processes, and future opportunities.

Over time, patterns start to emerge, like who prefers early, informal conversations; who only shows up once a process is already crowded; and who consistently brings you the strongest deals.

The result: Banker outreach becomes more targeted and timely rather than reactive, making for smarter engagement with intermediaries who shape deal flow.

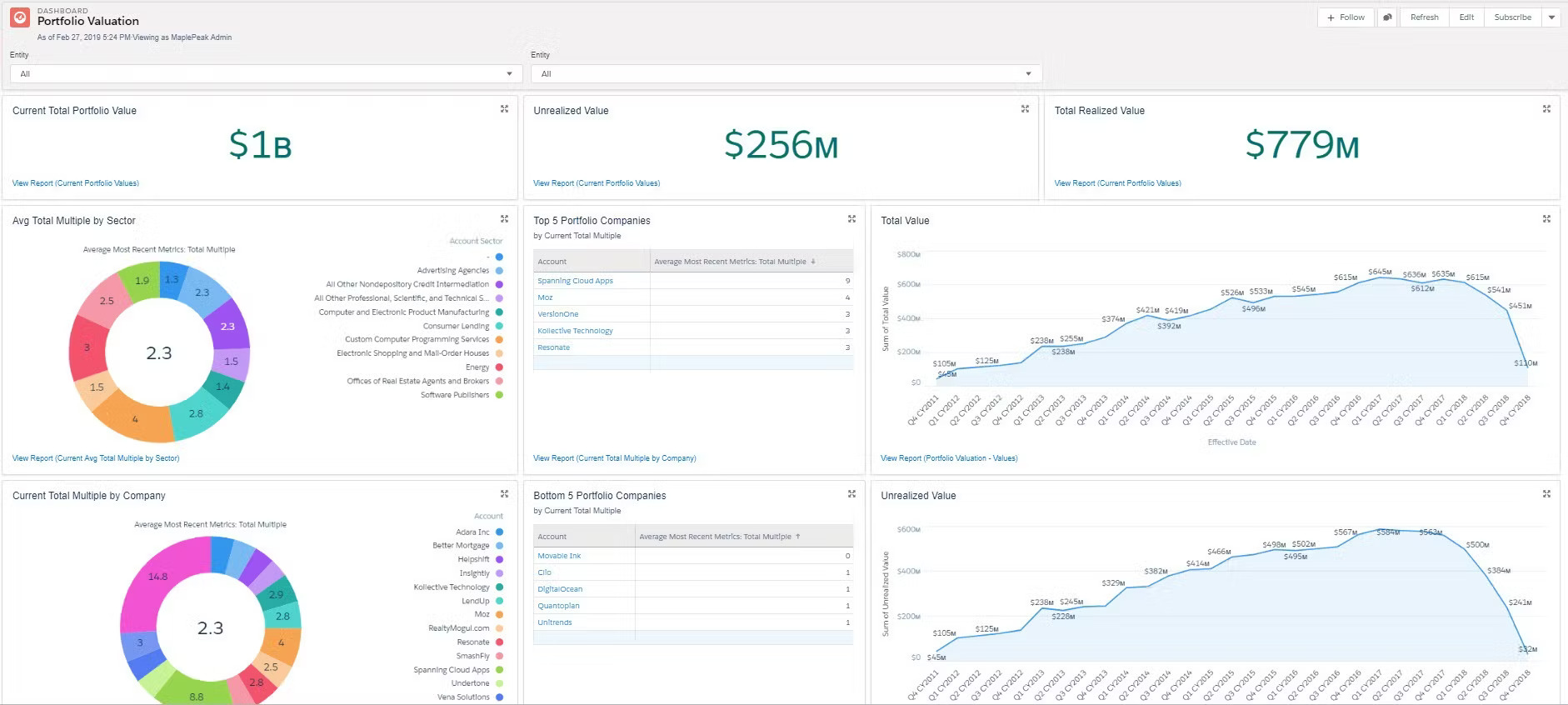

Fundraising and investor relations depend on continuity. Relationships span multiple fund cycles, with long gaps between them and countless touchpoints in between. When that history isn’t clearly captured, partners have to relearn the same information every cycle.

A dedicated fundraising and IR module gives teams a structured view of LP relationships over time. It centralizes commitments, past conversations, preferences, concerns, and communication patterns, so context doesn’t disappear when teams change or years pass between fundraising rounds.

The impact shows up quickly. A partner preparing for a meeting can see how an LP engaged in the last fund, what questions came up during the process, and what level of detail they expect in updates.

The result: A strong IR module helps firms communicate with intent, build trust across fund cycles, and manage LP relationships with the same consistency and intent they apply to deal sourcing.

The best private equity CRM platforms support relationship-driven sourcing, fundraising, and collaboration. But not all CRM tools are built with PE workflows in mind.

The five tools on this list can help your firm build strong relationships that drive better deals.

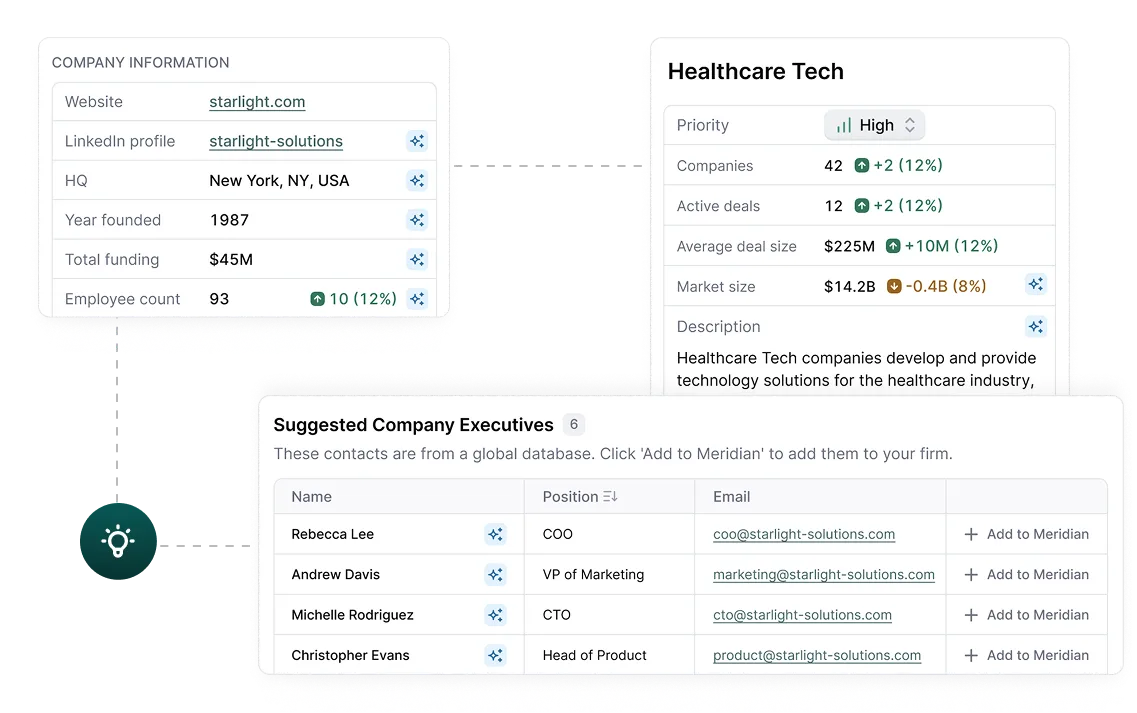

In private equity, access and timing are rarely accidental, and a good CRM system can help to build the relationships that lead to successful deals. Meridian understands that.

Built by PE professionals for PE professionals, it's designed to fit how firms actually work: with long deal cycles, relationship-driven sourcing, and constant context switching between companies, intermediaries, and LPs.

Automatic activity capture and sharing help teams record and preserve context that would otherwise live in inboxes or individual memory. This ensures that conversations, preferences, and history are recorded consistently, meaning relationships don’t reset when deal cycles stretch or team members change.

Relationship mapping and warm path identification features show who already has credibility with a founder, banker, or LP, and how those connections are linked across the firm. That visibility allows teams to coordinate outreach, personalize engagement, and better manage key relationships.

Plus, notes from past conversations, reminders of personal context, and insights surfaced by Scout, Meridian’s AI agent, enable teams to ask better questions and make more relevant small talk.

Meridian gives you the context and insights you need to nurture the connections that pay off.

4Degrees tracks interactions and network activity across sourcing, advisory, and fundraising workflows.

The platform focuses on helping firms keep track of the relationships that underpin sourcing, advisory coverage, and fundraising. It aims to give teams greater visibility into existing and potential relationships, making it easier to coordinate outreach and harder to lose context.

Rather than relying on individuals to log interactions, 4Degrees pulls data directly from inboxes to show how often, how recently, and through whom external contacts are engaged.

Affinity was designed for venture capital and can support firms that already have large, active networks that want better visibility into how those relationships evolve over time.

Rather than relying on manual CRM updates, the platform leans heavily on interaction data from teams’ inboxes and calendars. This demonstrates where engagement is building, stalling, or fading, and highlights which founders, bankers, or LPs are being engaged most often.

Affinity also automates data enrichment and hygiene, updating contact and company records as people change roles or organizations, so that relationship context stays current without manual upkeep.

DealCloud blends deal execution with relationship tracking to give teams a handle on complex workflows.

It centralizes contacts, companies, deals, and activity to provide an overview of connections and interactions over time. The platform also integrates proprietary and third-party data to enrich relationship and firm intelligence.

DealCloud includes tools for managing intermediary and lender coverage, tracking LP engagement, and monitoring fundraising and investor relations alongside deal flow.

Altvia’s private capital relationship management platform monitors interactions across calls, emails, and meetings.

From a relationship tracking perspective, the tool prioritizes consistency and traceability. Communication history is logged centrally so teams have a clear record of who’s been contacted, what was shared, and when.

Beyond the CRM, Altvia’s investor portals and reporting tools support consistent, trackable LP communications after capital has been raised. This helps firms deliver repeatable, auditable communications to investors without relying on ad-hoc emails or individual inboxes.

Private equity always has (and will always) run on relationships. What’s changing now is how firms capture, share, and act on the intelligence behind those relationships.

Meridian gives teams a shared view of relationship context. That means access, timing, and intelligence are all shared across the firm, not locked in individual memories. This team-wide context sharing and coordination make both meeting prep and long-term relationship management far easier and more scalable.

Scout plays a central role here. The AI agent continuously monitors markets and company lists, surfaces relevant signals, and takes care of low-leverage work through dynamic list monitoring and task automation. That frees sourcers up to spend more time in conversations that actually move deals.

As the future of private equity CRMs leans toward relationship intelligence, Meridian gives you a practical edge, turning shared context and timely signals into more effective sourcing and better deal outcomes.

Discover how Meridian can streamline deal sourcing and enhance your decision-making

Meridian is your team’s ultimate context provider, driving better deals while minimizing manual data entry.

Relationship management software helps private equity firms track and organize interactions with founders, bankers, LPs, and advisors over long deal cycles. These tools centralize communication history, contact details, and engagement data.

In private equity, relationship management involves capturing interactions (emails, meetings, notes), analyzing engagement patterns, and surfacing connections over long deal cycles to find where warm paths exist across the firm.

Private equity relies on trust and timing. Strong relationship management ensures firms maintain context across long deal cycles so they can act on warm paths rather than relying on cold outreach.

Table of Contents

Discover how the right CRM can automate research, enrichment, and workflows to help PE teams source faster and get ahead of high quality deals.