Meridian raises $7M seed round led by 645 Ventures.

Read More

Implement a CRM for private equity with fast deployment, clean data migration, and best practices that accelerate time-to-value.

Choosing the right CRM isn’t enough; you need a tactical playbook that can help you get your system up and running with minimal disruption to your deal flow.

And while most private equity firms have a customer relationship management (CRM) solution, few actually know how to make the most of it from day one. Migrating legacy spreadsheets, onboarding busy deal teams, and keeping momentum alive during a CRM implementation process that drags across quarters can stall even the best intentions.

This article outlines best practices for CRM deployment to help your firm get more value from the system and improve deal management processes.

If you want to beat competitors to the deals that matter most, you need specialized relationship management software that acts as a single source of truth. Excel spreadsheets and email chains no longer cut it in the private equity world.

A CRM built for private equity should help your team with:

The key to faster, smoother implementation is structuring a realistic, phased project around a CRM that’s built specifically for private equity. Without this implementation plan, a CRM system rollout can drag on for six months, a year, or even longer.

No two private equity firms find deals in the same way. And that’s exactly why implementation should start with aligning your private equity CRM around your deal sourcing model.

Whether your team runs thematic sourcing plays or depends on strong intermediary relationships, your CRM should reflect how you track opportunities, evaluate fit, and manage your deal pipeline.

This phase is where you define which fields matter most, how you categorize intermediaries, which tags signal deal priority, and what a standard record should contain. Without this clarity, every other phase will feel messy.

How long does it take? Getting this done should take around three to five days if your firm already has a clear sourcing strategy and naming conventions. If not, plan for a week or two of working sessions across deal and sourcing teams.

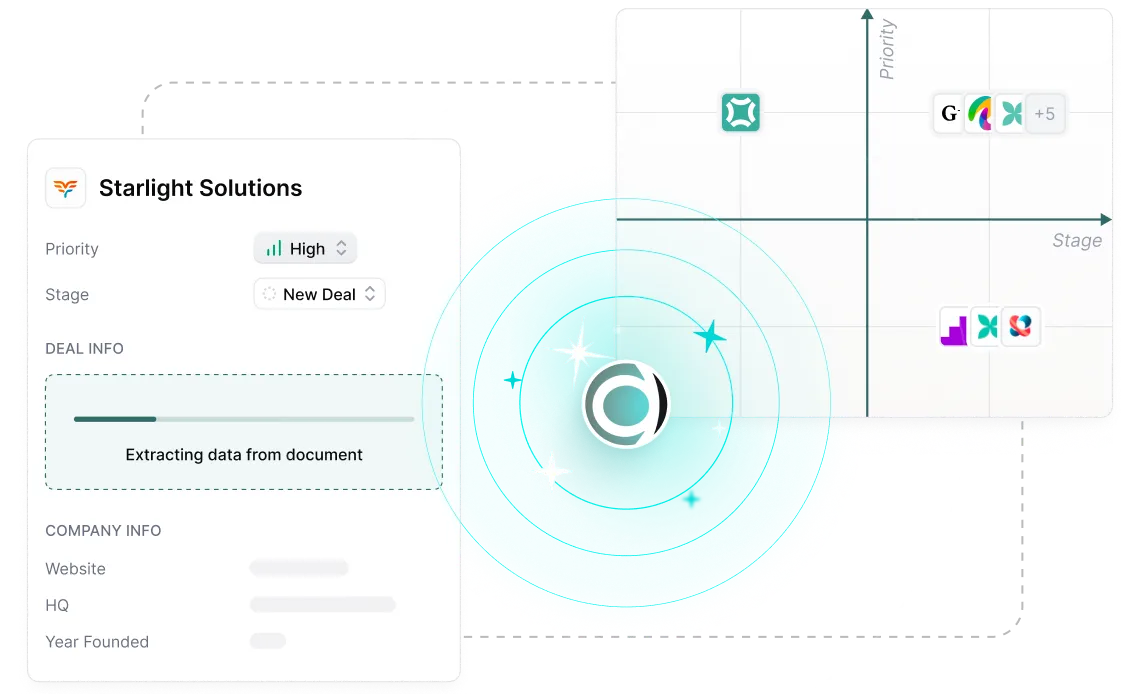

A private equity CRM is only as good as the data it holds. If your deal team can’t trust what they see, they’ll end up going back to spreadsheets and manual inbox searches.

This phase is about getting your contacts, companies, activities, and deal history out of Excel and Outlook and into your CRM platform, then mapping all of that clean information into your new structure.

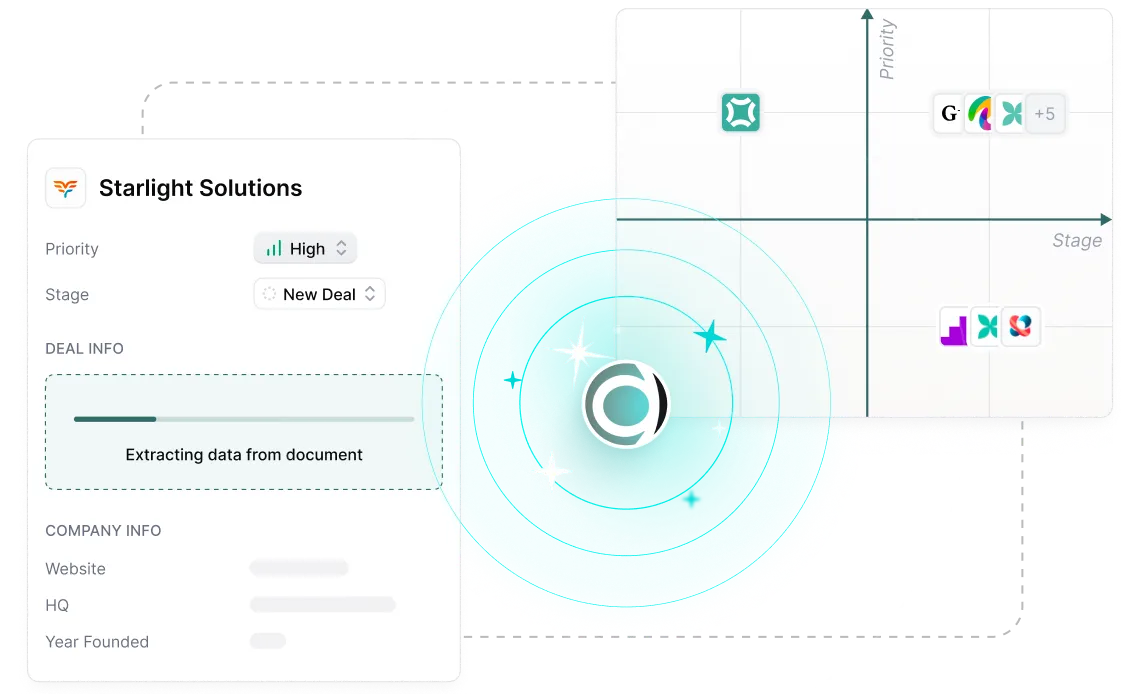

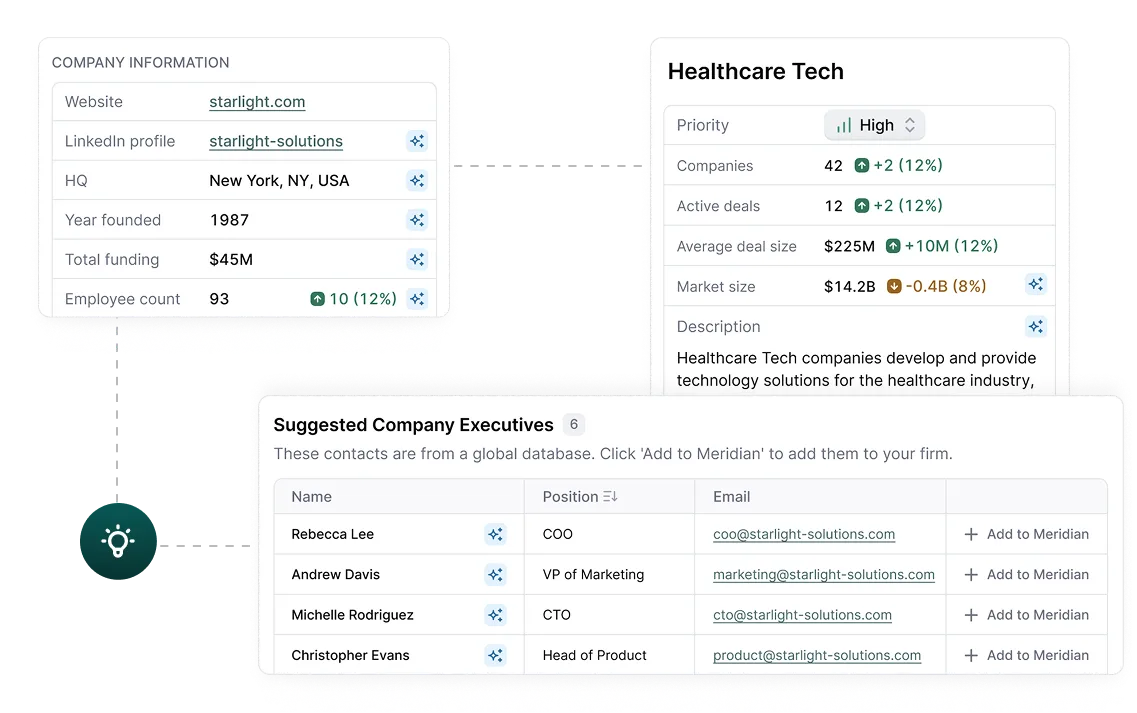

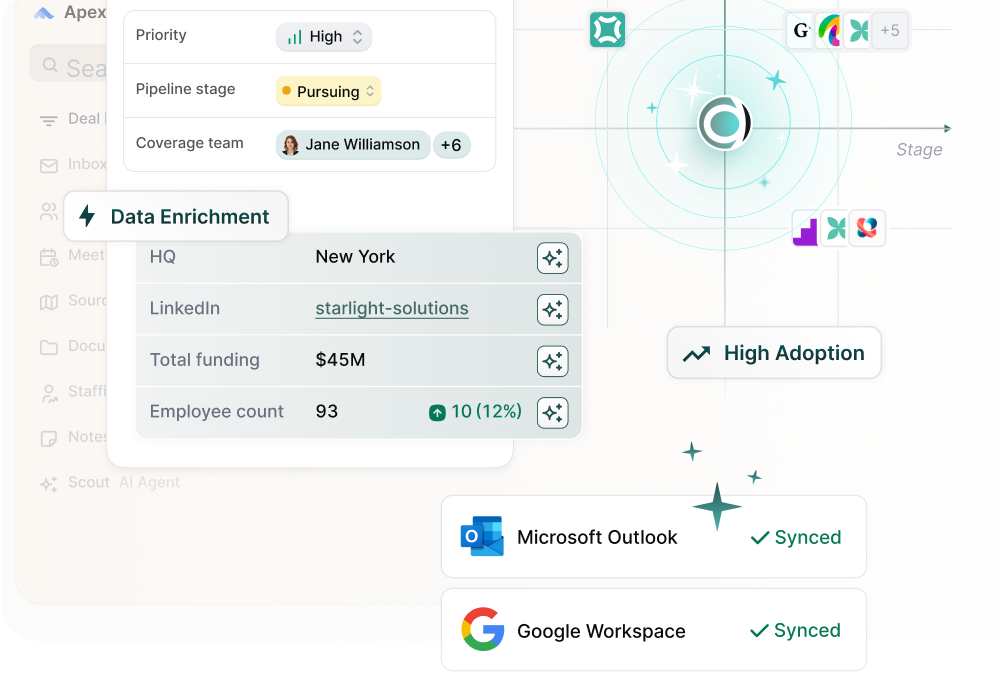

Modern private equity CRM solutions can auto-fill missing firmographics, pull in helpful signals like hiring shifts, and update bios to save you time and make your platform useful from day one.

How long does it take? With AI-powered enrichment and contact resolution, a large portion of cleanup can be handled in the background, cutting the timeline for this phase from a couple of weeks to just a few days.

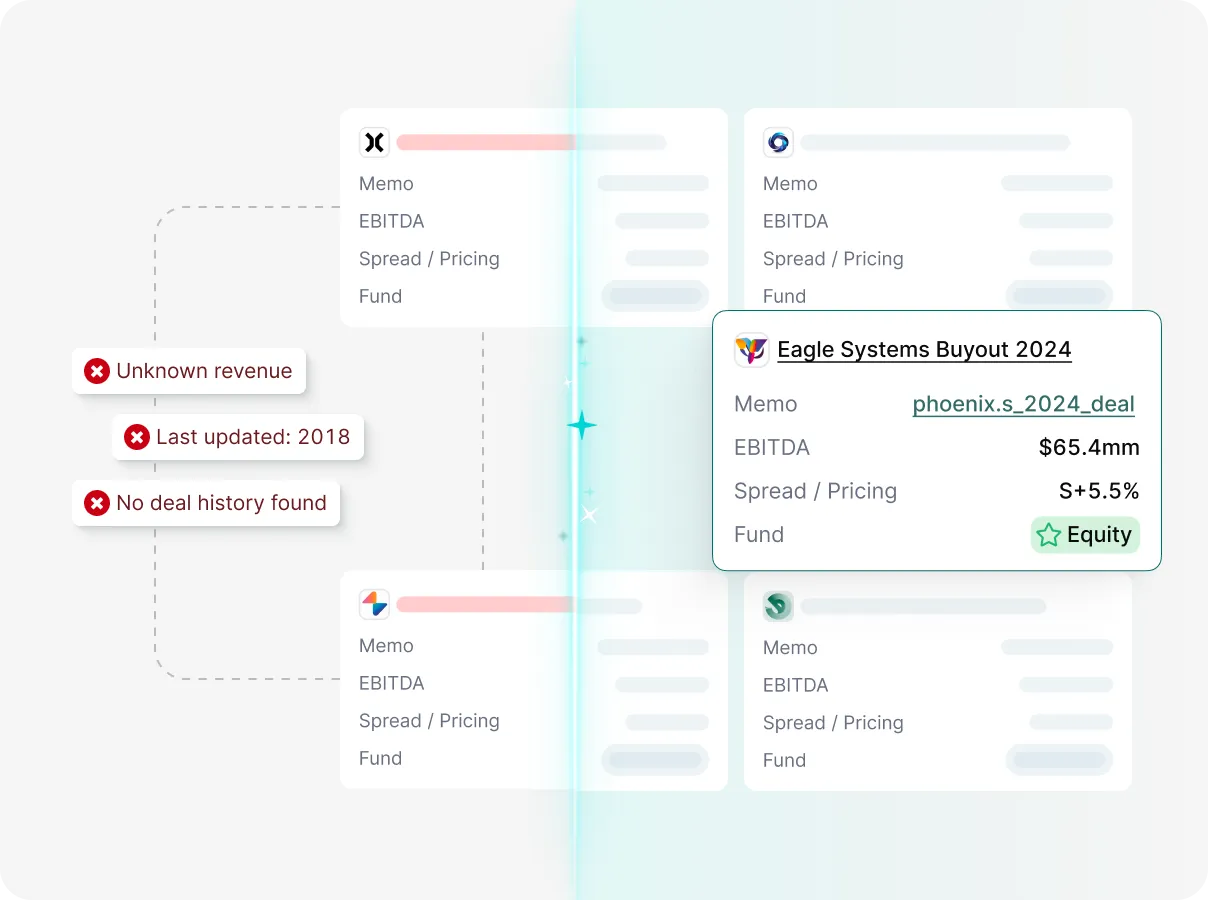

Good deal flow management depends on visibility, and that starts with a pipeline structure everyone agrees on. You’ll want to define your deal stages, set up automated reminders or ownership rules, and build views that make it easy for team members to see what’s moving (and what’s stalled).

A typical deal journey might include “Initial Outreach,” “CIM Reviewed,” “Diligence in Progress,” “IC Approved,” “LOI Sent,” and “Closed/Won.” You can also layer in workflows for pipeline review meetings, IC prep, target outreach cadences, or whatever else fits your team’s workflows.

How long does it take? Factor in a couple of days to a week with a CRM solution that’s built for private equity. Add a few more days if you’re building custom automations or integrating third-party tools like email, calendars, or storage and file sharing.

There’s more to using CRM software successfully than just flipping the “on” switch. Even after onboarding, you’ll need to check in regularly with your team to see what’s working, where the friction points are, and what workflows might need a little fine-tuning.

It’s also worth keeping in touch with your CRM vendor. Market-leading CRMs regularly roll out new features, automations, and improvements. If your provider doesn’t add in-platform prompts and updates about new functionalities, make a point to reach out and ask.

How long does it take? Plan for an extended onboarding period of two weeks to a month where your team uses the CRM in real deal scenarios. Encourage feedback early and often, and be ready to make small adjustments. Creating a light-touch feedback loop early on will save you months of frustration later down the line.

Even with the best private equity CRM, implementation can stall without the right internal strategy. From data migration to change management, a few key best practices can make the difference between slow adoption and fast, firm-wide ROI.

If data migration doesn’t run smoothly, the CRM won’t either. It’s the one part of the rollout that, if mishandled, can sink the entire implementation.

Private equity firms often underestimate how fragmented their data really is: scattered across Excel files, inboxes, legacy systems, and the minds of senior partners.

And it’s not just about getting names and numbers in the right columns. You’ll need to account for ownership history, activity records, intermediary linkages, company stage, and more.

The smartest move is to work with a CRM that handles the migration for you, like Meridian. We do the heavy lifting for you, so your team isn’t stuck parsing spreadsheets or matching fields manually.

Running your new CRM alongside legacy tools might seem like a safe way to ease into rollout, but this approach almost always backfires. Parallel systems guarantee data drift, split attention, and uneven adoption.

Let’s say an associate logs a deal touchpoint in the new CRM, but a partner replies to the email thread and updates the legacy system. Now the deal status lives in two places, and neither is fully accurate. Multiply that by 50 opportunities, and you’ve got chaos.

The fix is simple: pick a cutover date, communicate it clearly, and commit. On that day, the new CRM becomes the system of record and the old trackers get archived. This sharpens accountability and accelerates adoption, because there’s nowhere else to look.

You can’t drive ROI from a platform no one’s using. Going all-in from the start (with training and support in place) builds momentum and helps your private equity CRM software become a core part of daily workflows faster.

Implementation is a team effort, and everyone, from associates to partners, needs to be invested in working towards a shared goal.

The most common reason why adoption fails is because the firm’s workflows still orbit legacy systems. If teams are still preparing IC memos from spreadsheets or tracking outreach in personal inboxes, they’ll never treat the CRM as the main source of truth.

That’s why change management needs to be intentional. Re-anchor workflows to the new system. Run outreach directly from the CRM. Use it to prep IC memos, update deal status, and log touchpoints. The more the software reflects daily reality, the faster adoption clicks into place.

Top-down buy-in is critical here. If managing partners don’t use the system, everyone else will follow suit. Pair leadership’s example with targeted training for power users, and you create internal champions who can troubleshoot and keep the rollout moving.

Private equity deal teams are already underwater juggling live deals, outreach, IC prep, and banker comms. They don’t have time to manually update contact details or company profiles.

The best way to keep your system accurate (and actually useful) is to build in CRM automation from day one. That means using tools that automatically pull in firmographics, update job titles, flag bounced emails, and log touchpoints without manual data entry.

When enrichment runs in the background, your team can always trust that your private equity customer relationship management records are up to date without giving it a second thought or double check.

This kind of automation also helps uncover new relationships, track role shifts, and spot re-entry points with targets that may have gone quiet.

Most CRMs are built to track activity: emails sent, meetings held, notes logged. And while that’s useful, it’s not enough.

The firms that win deals early are the ones tracking signals: the subtle, forward-looking cues that suggest a company is open to a conversation. Think new executive hires, international expansion, shifts in messaging or pricing, an uptick in job postings, or sudden surges in PR.

This difference is also part of the reason why AI often fails in private equity. Generic tools don’t understand the difference between noise and actual signal. They surface activity but miss context.

But an AI-native CRM system like Meridian will help you layer signals on top of activity so your team knows who to contact in addition to when and why. That’s what drives sharper sourcing, better timing, and a real edge in competitive markets.

PE CRM implementation can take anywhere from a few days to months, depending on what you need to do and the system you choose. Below are typical rollout timelines for some of the more common CRM solutions used by private equity firms.

Choosing the right CRM is a win, but implementing it well is what unlocks long-term sourcing advantage. With Meridian, your team can move from spreadsheets to full adoption in just weeks.

Automatic data import and enrichment reduce migration overhead, while AI-powered market mapping gives you an immediate lift in sourcing precision. Plus, zero-friction Outlook and Google Workspace sync anchors daily behaviour inside the platform, making adoption feel natural, not forced.

If you're looking for the best private equity CRM to drive better deals, deeper relationships, and real ROI, Meridian is built to get you there without the lag.

Meridian’s AI-native solution gets you up and running in mere weeks, not months.

A CRM in private equity is software that’s designed to manage deal pipelines; track relationships with companies, intermediaries, and LPs; and centralize key firm data so teams can spot investment opportunities faster and make informed decisions.

The timeline for implementing a CRM in private equity varies depending on your data readiness, firm complexity, and whether you use automated tools. The quickest way to get going with a PE CRM is to use Meridian. It’s a purpose‑built PE CRM ready to go live in just weeks.

You should migrate key data like:

Also include critical metadata like ownership, past interactions, and status history to make the CRM immediately usable.

Treat training as an essential part of roll‑out. Start with a small group of power users and walk them through core workflows before expanding training firm‑wide. Include real‑life use cases and encourage hands-on learning to build familiarity with the CRM solution.

Discover how Meridian can streamline deal sourcing and enhance your decision-making

Table of Contents

Gain an in-depth understanding of private equity relationship management software so you can pick the tool that best fits your firm’s needs.