Meridian raises $7M seed round led by 645 Ventures.

Read More

Market intelligence gives PE firms a competitive edge for sourcing and closing the best deals. Learn about the workflows and tools top firms turn to.

When analysts scramble to gather signals from emails and spreadsheets, valuable insights become siloed or lost. High-quality opportunities slip through the cracks, timelines get tighter, and firm knowledge doesn’t accumulate.

Sound familiar? If your deal team relies on ad-hoc research, your people are constantly reacting instead of getting ahead and spotting opportunities proactively.

A systematic, theme-driven market intelligence program fills this gap. It helps you define a sector thesis, tracks signals across multiple sources, and feeds verified data into a repeatable workflow.

This approach enables your deal team to surface opportunities earlier by building a persistent view of the market that compounds over time. Let’s look at why market intelligence should operate as a structured system, what a high-performing workflow looks like, and the tools PE firms use to track signals and targets.

Private equity firms are competing in a tighter space than ever. Auctions are more crowded, timelines are shorter, and LPs are asking tougher questions about sourcing edge and attribution.

The firms that consistently win aren’t relying on intermediary relationships or fragmented research. They’re operating with a defined system.

A systematic market intelligence model means your team works from shared inputs and common definitions. Everyone speaks the same language about what makes a company attractive, what a signal means, and how often intelligence is refreshed.

Data flows on a recurring cadence, be it weekly or monthly, into dashboards that show which subsectors, target profiles, or geographies have been analyzed and which areas still need coverage.

It’s about turning market signals into an operating system your entire team can rely on. And over time, that discipline compounds: coverage widens, sector expertise deepens, and you start spotting opportunities years before they even reach an auction.

Most investment professionals only see 10% to 30% of deals within their target market. In other words, most opportunities never even make it onto a firm’s radar.

Ad-hoc research is how good opportunities quietly slip away. One associate might track a promising sub-sector in a spreadsheet, while another might have a dozen CIMs buried in their email. When sourcing isn’t centralized, information gets lost, duplicated, or forgotten about entirely.

And by the time a company resurfaces through a banker, you’re months behind a competitor who’s already built conviction. The result is scattered institutional knowledge, an inconsistent view of the market, and missed windows.

For deal teams focused on finding the best opportunities, ad hoc research slows progress and weakens results. Systematic intelligence is insurance against lost deals and duplicated work.

A high-functioning market intelligence operation is structured, repeatable, and connected directly to sourcing outcomes.

A strong model relies on a common language across your deal team, where everyone understands what constitutes a signal, how companies are classified, and which metrics matter most for evaluation.

That shared vocabulary feeds into centralized dashboards that track coverage across sectors, sub-themes, and companies, giving teams a real-time view of the market. And workflows seamlessly connect market research with your CRM, so insights and signals can trigger actionable steps rather than sit idle in spreadsheets or emails.

Data typically flows from a mix of internal systems and external sources.

Once collected, these disparate data points are standardized into a common format, verified for accuracy across multiple sources, and integrated into your CRM. The result is a consistent view of each company or opportunity.

Outputs are designed to be used by deal teams right away.

Roles and ownership are just as important.

When combined with a formal, centralized knowledge base, clearly defined responsibilities help prevent key man risk to ensure that coverage continues even if a single person leaves or switches teams.

Cadence is scheduled, with regular review cycles to update dashboards, re-rank targets, and refresh alerts. This structured approach compounds knowledge, creating a firm-level understanding of sectors that surface potential opportunities years before they reach an auction.

PE teams need the right platforms to track companies, sectors, and market signals. Below, we explore some PE market intelligence platforms to help you uncover insights that put you in front of the best deals.

PitchBook tracks deals, investors, companies, funds, and people. It surfaces capital flows, investor behavior, valuation trends, and sector benchmarking. You can connect its data directly to your CRM software via an API or built-in integration and deliver the same data into Excel or PowerPoint.

Prequin gives teams private markets data across firms, funds, deals, and investors globally, surfacing more than 775,000 deals and exits across asset classes. It offers detailed fund-performance benchmarking and fundraising activity, as well as investor profiles and trend signals, to help you spot hiring shifts and emerging sub-themes.

Sourcescrub is a platform focused on private-company intelligence, and it offers data on over 17 million firms verified across over 290,000 sources. It gives you signal-driven filters like hiring changes, funding events, and product launches, plus an AI-driven workflow to enrich company profiles.

CB Insights delivers predictive intelligence on private companies and markets using machine learning algorithms with curated datasets. Its APIs and data feeds enable deal teams to embed verified signals, such as funding shifts, hiring moves, patent activity, and business relationships, into CRM and sourcing workflows.

CEPRES gives teams a private-markets data analytics platform built around a network of over 16,500 funds and more than 140,000 unique deals. It supports benchmarking, market-cap creation, and trigger alerts through point-and-click analytics.

The tools listed above may give you company data and sector insights, but a lot of that information never reaches the people who need it. Many private equity CRMs operate in silos, and pipelines aren’t automatically updated with the signals teams track.

This creates gaps. Opportunities go unnoticed, follow-ups are missed, and intelligence doesn’t compound across your firm.

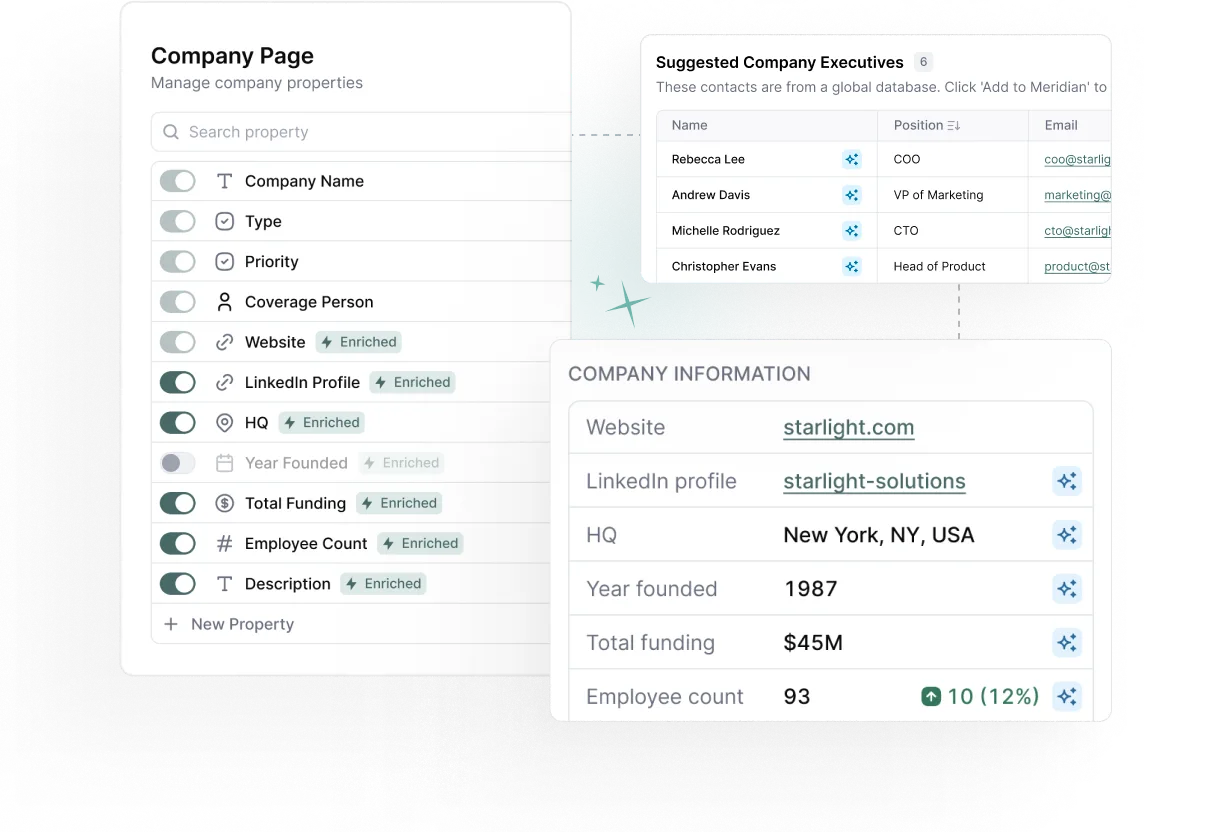

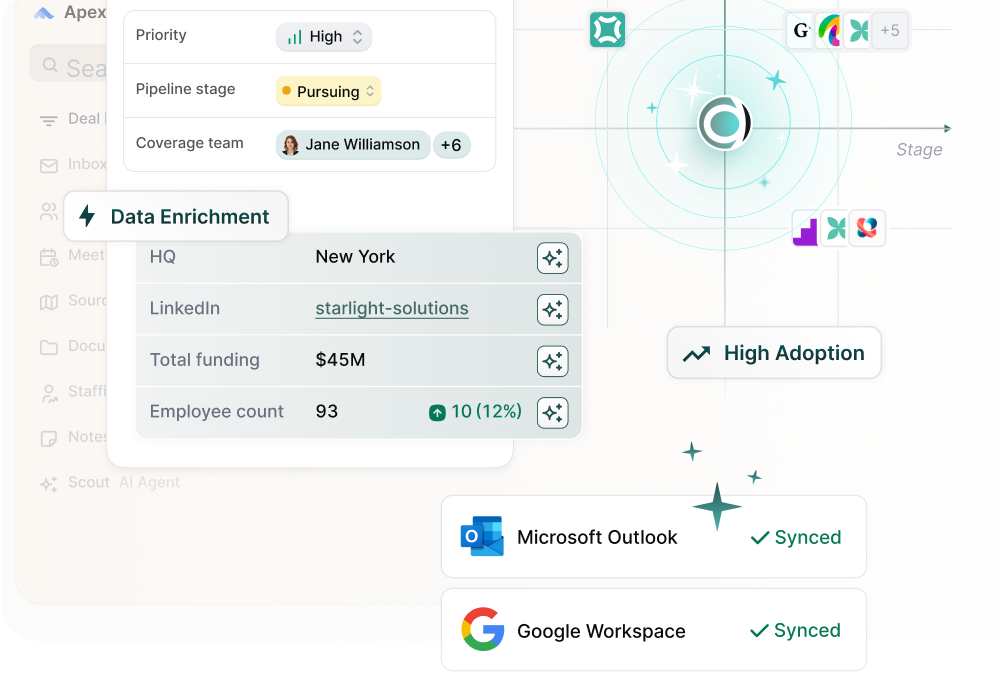

Meridian tackles these weaknesses by embedding verified company and executive data directly into workflows, which ensures the right information flows to every member of your team.

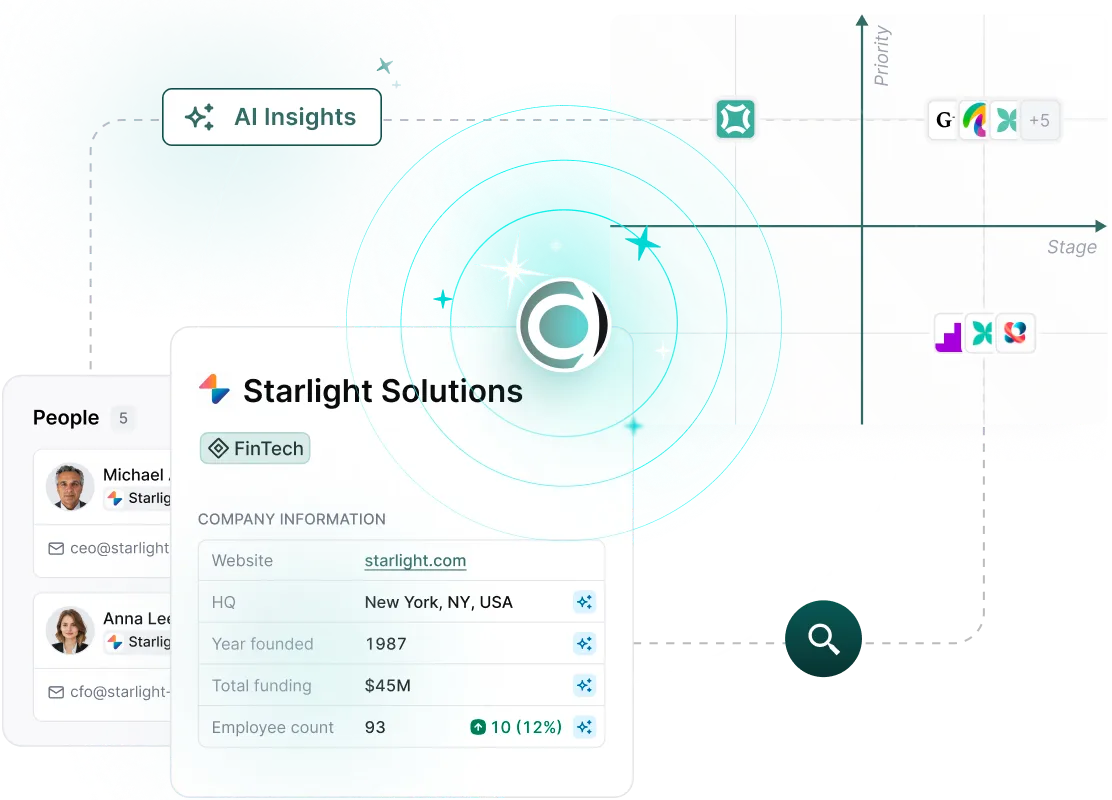

The platform’s workflow begins with Scout AI, which continuously monitors 26+ million company records and executives to surface high-potential opportunities.

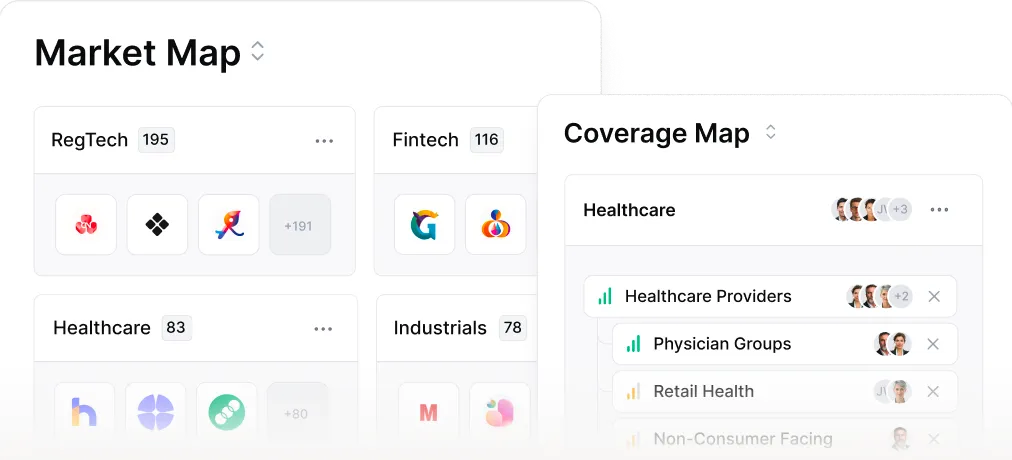

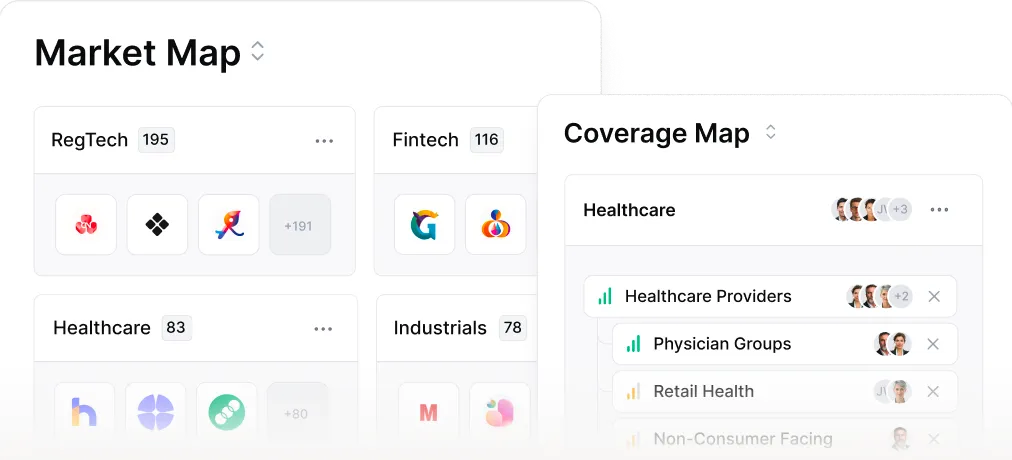

Data from public filings, funding announcements, hiring activity, and third-party sources is enriched and synced automatically in your CRM. This allows teams to build market maps, keep ranked target lists, and get trigger alerts without manual updates.

Intelligence flows freely across the platform, and ownership is clear. That means analysts collect and enrich signals, associates update market maps, and senior team members review and validate IC-ready briefs.

With Meridian, opportunities are surfaced earlier and insights compound over time, which creates a firm-level advantage in sourcing and executing high-quality deals.

Meridian’s Scout AI agent surfaces and benchmarks new opportunities so you can find winning deals before the competition.

Firms that run market intelligence as an operating system are the ones spotting the best high-potential opportunities before anyone else.

Meridian brings that system together all in one place. Rather than paying for disjointed market data platforms, you get all the information you need bundled right into your CRM. And in practice, this means better deal insights than your competitors.

The platform lets you put a tracker on companies to get notified automatically of changes. When this happens on a large scale, you’re more informed than competitors, which leads to better deals. But manually, it’s impossible.

Firms that use a systematic, tech-enabled approach to market intelligence build a compounding advantage and can gain early access to high-potential targets, positioning them to win the next cycle’s most attractive deals.

Discover how Meridian can streamline deal sourcing and enhance your decision-making

Define your thesis and get insights into companies that fit it with AI-powered data enrichment and thematic sourcing features.

Private market intelligence is the systematic gathering, analysis, and tracking of company and sector information. It helps deal teams spot emerging opportunities and do market trend analysis for private equity. It also enables informed decision-making before deals reach competitive auctions.

AI in private equity supports deal sourcing, analysis, and market monitoring. Tools like Meridian’s Scout AI scan millions of company records to surface high-level opportunities and tracking themes.

AI is also being used in private equity to automate data enrichment, reduce duplication, and sync CRMs. This enables teams to focus on evaluation and decision-making rather than collecting and recording data manually.

A CRM in private equity is a platform for managing company, investor, and deal information. A platform like Meridian tracks communication and stores intelligence while enriching company data and facilitating thematic sourcing workflows.

Table of Contents

Gain an in-depth understanding of private equity relationship management software so you can pick the tool that best fits your firm’s needs.