Meridian raises $7M seed round led by 645 Ventures.

Read More

Explore the top private equity themes for 2025/2026 and learn why thematic sourcing is critical in today’s market.

Steep competition and increasingly crowded auctions are leading private equity firms to turn towards a thematic approach to deal sourcing. Rather than chase bankers and opportunities already on the market, the smartest firms build out long-term strategies that focus on winning industries and track themes over multi-year timelines.

But if identifying the emerging PE themes worth investing in were that easy, every firm would be as big as Blackstone and Thoma Bravo.

We want to help firms be as successful as possible in their thematic sourcing. That’s why we’ve taken the time to round up seven promising private equity themes firms should explore to find deals that deliver strong returns.

When you don’t take a thematic approach to deal sourcing, you risk falling behind. With so much of the economy operating in private markets and so many companies being bought up by private equity investors, there are more firms operating than ever before. And you can’t expect to show up to an auction and pay the best possible price for a competitive deal.

Thematic sourcing gives firms a competitive advantage, which shifts the approach from deal chasing to thesis-driven investing. By identifying and tracking companies far before they reach auction, you can better anticipate long-term value and avoid overpaying for crowded opportunities.

And in the private equity industry, firms that engage in sector-specific research and gather thematic market intel achieve better long-term investment outcomes. Not only are you ahead of the best deals, but sector-specific experience also helps your team excel in portfolio management; when they understand an industry inside and out, they’re better equipped to make decisions that yield the best business outcomes.

What’s more, thematic sourcing helps you differentiate when it comes time to secure funds. LPs want to see a strong proprietary pipeline. And a strong ratio of pre-empting auctions to traditional sourcing helps you demonstrate your firm’s proactive, strategic pipeline approach.

Which themes are worth exploring and investing in is a core question for private equity firms today. We’ve taken a deep dive into seven private equity themes that look to promise investment opportunities with high deal value and returns.

It’s no secret that the AI industry is growing at an unprecedented pace, accounting for nearly 92% of US GDP growth in the first half of 2025. What hasn’t quite kept pace is AI regulations, but that doesn’t mean we won’t be seeing them soon.

The EU AI Act has paved the way for regulatory compliance of LLMs and other AI tech. And while the US still lacks a federal regulation, states are taking their own steps towards stricter governance, with all 50 enacting some sort of AI legislation in 2025.

This leaves a big gap for businesses that leverage AI in their workflows and need to find a way to achieve and maintain compliance in a regulatory space that’s constantly evolving.

AI governance firms and compliance platforms fill the gap for businesses that want to deploy AI compliantly but lack the internal resources and knowledge to do so. Companies predicted to see continued growth range from specialized compliance consulting firms to SaaS tools that support with regulatory obligations.

Climate variability is leading to an increased frequency and intensity of extreme weather events. For example, hurricanes and typhoons fueled by rising temperatures are becoming increasingly destructive, which causes more widespread impact, damage, and costs.

From wildfires and tornados to hurricanes and floods, climate disasters caused billions of dollars in damage in 2024 alone. This situation has led to a higher claim frequency and severity, and insurers prefer dependable, code-compliant vendors with fast response SLAs.

The demand for regional restoration platforms with 24/7 dispatch, as well as temporary housing coordination, sees ongoing growth, namely in states and regions that experience higher rates of natural disasters, like California, Florida, and cities along the Gulf Coast.

In 2024, the EPA finalized the first national drinking-water standards for PFAS, which sets legally enforceable limits for several “forever chemicals” found in water. The EPA estimates that as many as 6,600 public drinking water systems may have to take action to reduce PFAS to meet these new standards.

As of 2024, public water systems were given three years to complete initial monitoring for these chemicals and inform the public of PFAS levels measured. Where PFAS is found to exceed standards, cities have five years to implement solutions to reduce the presence of these “forever chemicals”.

Regional labs and field-testing providers, as well as water treatment and remediation solutions, will prove necessary for the thousands of cities that don’t currently meet EPA standards.

In 2024, for the first time ever, the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) publicized details on nearly 900,000 reported workplace injuries and illnesses recorded by the agency. This disclosure put workplace safety and recordkeeping under increased scrutiny from both the agency and the general public.

Companies with serious infractions or poor safety performance risk both regulatory damage and reputational harm among employees, customers, and unions. This underlines the importance of improving record keeping, proactively addressing workplace hazards, and strengthening worker safety programs.

Employers need to meet OSHA standards, standardize reporting, and reduce workplace incident risk. Regional networks of occupational health clinics, workplace safety consultancies, and compliance management software providers will all be key here.

Pet ownership is at an all-time high, with over two-thirds of US households owning a pet. Consequently, pet spend is also on the rise, with owners spending a projected $157 billion on food and dress, medicine, vet care, and other expenses in 2025.

And it’s not just traditional wellness visits or grooming that owners are shelling out on. Pet calming products, for example, have increased in popularity, with the majority of Gen Z and Millennial dog and cat owners shelling out for this niche type of pet care.

Aside from general practice and specialty vet clinics, mobile and urgent-care vet services, grooming and boarding, and pet wellness products all offer interesting investment themes.

The 65+ age group makes up a growing share of the US population, far outpacing the population growth of other age groups in the last 70 years. This proportion of older adults will keep rising into the 2030s, especially with advances in healthcare and preventative treatments.

At the same time, aging in place is growing in popularity among older adults and their families, with 93% of adults over the age of 55 stating that they view it as an important goal. This pushes the demand for personal care agencies, companion services, home retrofits, and other related products and services.

From wearable health monitors and alert devices to home modifications like bathtub remodels and ramps, aging in place tools and infrastructure present interesting opportunities. At the same time, home health aid providers and related services are growing in demand.

US dental practices struggle with rising labor costs and staffing shortages, with nearly 24.7 million people living in dental health professional shortage areas (HPSAs). This issue disparately impacts rural areas, which have, on average, just one dentist available for every 3,850 people. In these areas, ED visits are also more likely.

Only four states (and Washington, D.C.) were found to be free of HPSAs. When coupling this shortage of dental professionals with insurance gaps and financial barriers, we find that people lacking private dental insurance are seven times more likely to visit the ED.

Regional networks of urgent-access dental clinics, as well as teledentistry providers that offer rapid triage, are becoming increasingly important as HPSAs persist and millions of Americans live without sufficient preventative dental care. These opportunities are especially interesting in rural areas, where dental access is particularly scarce.

No matter how smart your sector and industry insights are, you can’t build out a scalable, reliable thematic sourcing strategy without the right tech. And manual research and scattered data present PE challenges like key man risk, an inability to track themes over multi-year cycles, and disorganized contact records.

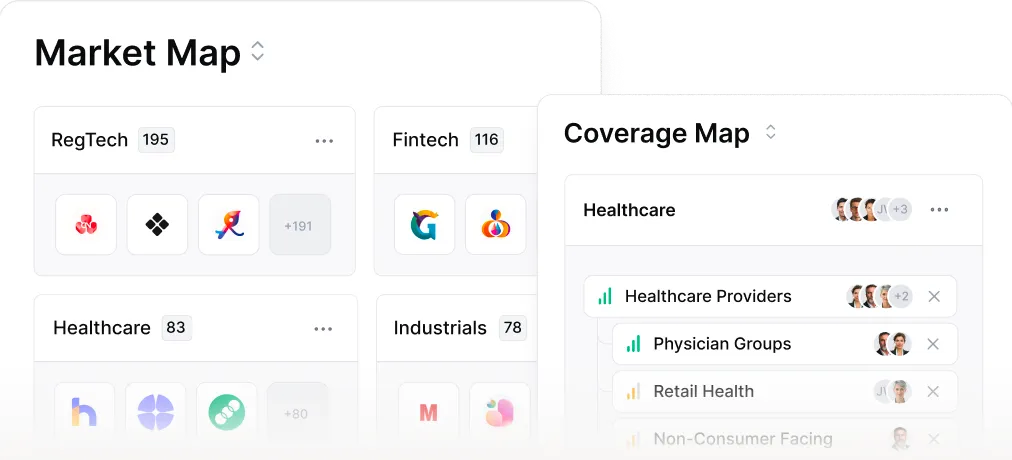

A dedicated thematic sourcing tool helps your team easily track trends, map key markets, and identify target companies with minimal manual effort. This tech makes the process more scalable, as it provides faster, repeatable ways to validate themes and find targets across sectors.

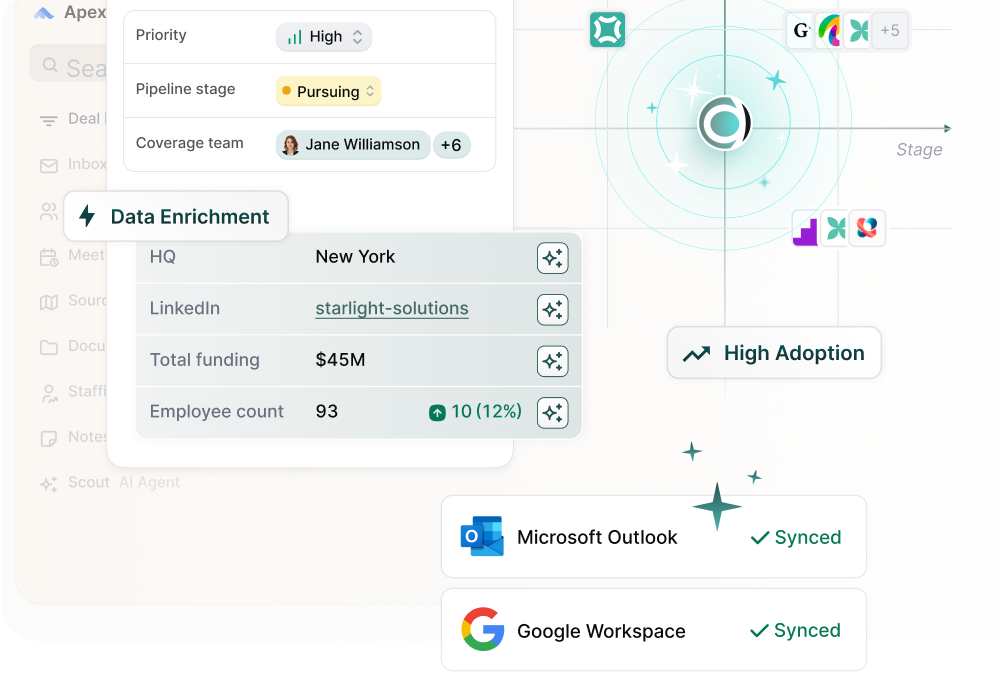

For example, Meridian’s AI agent Scout powers your entire deal workflow, from instant market mapping and visualization to data enrichment with zero manual input. The tool maps your target market based on investment theses to surface new companies, reconnect you with old ones, and set you up for smarter outreach.

Define your thesis and get insights into companies that fit it with AI-powered data enrichment and thematic sourcing features.

Meridian is your partner for data-driven thematic sourcing that delivers better deals. The platform offers:

All of this enables smarter decision making, without your team having to manually compile and share data. Meridian takes the grunt work out of deal flow management so your associates, VPs, and partners can focus on crafting the strongest investment theses and finding the most promising opportunities.

Discover how Meridian can streamline deal sourcing and enhance your decision-making

Find out how leading PE firms are using Meridian to enhance their deal workflows.

.webp)

Proven private equity trends that deliver results include thematic sourcing, data-driven deal origination, and specialization within high-growth sectors. Firms are also prioritizing operational value creation over financial engineering, using AI and analytics to enhance due diligence and portfolio performance.

Private equity typically rests on four main pillars: sourcing, due diligence, value creation, and exit.

The Rule of 72 is a quick formula used to estimate how long it will take an investment to double in value based on its annual rate of return. To calculate, you divide 72 by the expected annual return.

For example, if a private equity fund targets a 9% annual return, the investment would roughly double in eight years (72 ÷ 9 = 8). It’s a simple way to benchmark compounding performance expectations.

The 80/20 rule, or Pareto principle, in private equity refers to the idea that roughly 80% of returns often come from 20% of portfolio investments. It underscores the importance of focusing resources on top-performing assets that drive outsized value creation.

Table of Contents

Gain an in-depth understanding of private equity relationship management software so you can pick the tool that best fits your firm’s needs.