Meridian raises $7M seed round led by 645 Ventures.

Read More

Learn how to build a repeatable sector research program that helps your firm surface targets earlier, improves outreach, and speeds IC decisions.

Most private equity firms aren’t short on capital; they’re short on time. Deal activity is up, bankers are running tighter auctions, and processes are moving so fast that ad-hoc thesis work can’t keep pace.

Sector-based investment research solves that problem. Instead of scrambling when a company is ready to sell, you’ve already mapped sub-verticals, tracked real signals, and made contact, far before it hit auction. In a market moving this quickly, that level of preparation is the only way to win.

Traditional sourcing is built around a limited pattern: wait for a banker to bring an opportunity to you, skim a generic deck, sprint through your due diligence, and hope the valuation doesn’t get pushed into the stratosphere.

The problem with this approach is that so many firms are running the same play. When buyers pitch at the same time with the same information and the same thin angle, multiples inflate, and real differentiation disappears.

A sector-based investment program turns that model on its head. Here’s how:

Most importantly, this approach is highly scalable and repeatable. You start top-down with thematic drivers, map relevant sub-sectors, evaluate which ones align with your strategy, then translate that work into a living target universe and IC-ready insights.

Key takeaway: Sector-based investment research provides a sourcing engine that systematically reduces dependence on banker flow, builds institutional knowledge, and increases your odds of getting to better opportunities first.

Sector-based research sharpens your view of a market and reshapes the entire deal cycle, from how opportunities enter your pipeline to how quickly you can move through IC. When you understand a sector deeply, every stage of the deal cycle tightens up.

Benefits of this approach include:

Sector-based investing takes you from a broad market view to a focused set of sub-sectors, themes, and targets your team can actually pursue. Here’s how to build out a repeatable process to make this possible.

Every sector-based research program starts defining what “a good deal” actually means for your firm. Not in a brainstorming session, but in a written mandate that anyone on the team can pick up and use as a guide.

This mandate should reflect your firm’s overall investment strategy and objectives rather than offering an abstract view of what a great company looks like. That means spelling your preferred ownership level, check size, EBITDA or ARR bands, geographic focus, and any hard risk tolerances.

You’ll also need three to five true investment non-negotiables: in other words, the characteristics that separate interesting businesses from actionable opportunities. For some firms, that might be recurring revenue profiles. For others, it could be unit economics thresholds, regulatory exposure, or customer concentration limits.

Key takeaway: When your criteria are explicit, you’re scanning only for signals that matter to your mandate. This creates clarity to help deal teams concentrate on the opportunities you actually want to go after.

Sector investing is all about narrowing the playing field. Choosing two to three sectors where your firm already has an angle, whether that’s operational experience, existing portfolio insights, or past performance, will give you the edge over your competition.

This is where the value of thematic sourcing starts to compound. This strategic approach enables you to choose themes where you can develop genuine edge.

Once you’ve chosen your focus areas, sharpen further into specific sub-themes within those sectors. Something like “ISV-led payment providers” is far more likely to surface new, exciting opportunities that are relevant to your investment strategy than a broad fintech angle.

Pro tip: Tighter themes can also lead to warmer introductions. CEOs aren’t typically interested in talking to generalists who are “exploring a space”. But they will engage with investors who can speak their language and understand the dynamics shaping the market they work in.

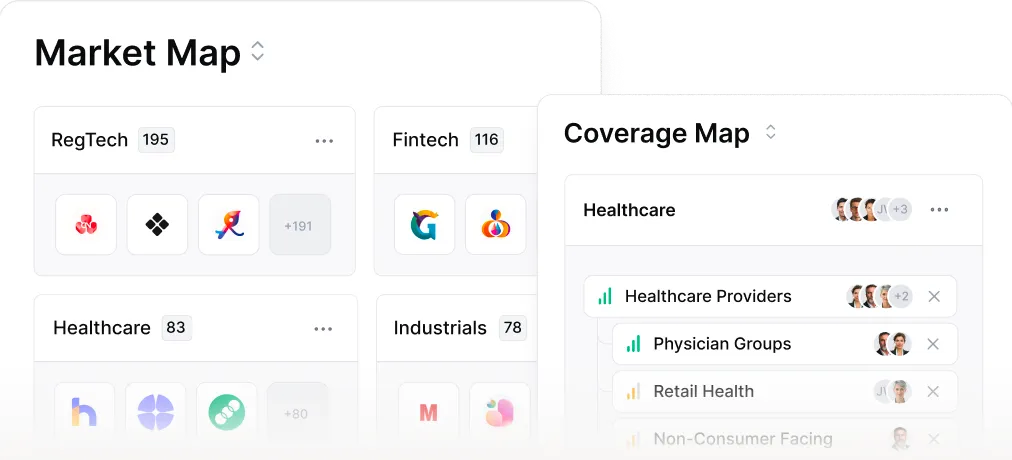

Mapping the landscape gives you and your team the foundation to understand how the market actually works. You want a clean view of the sub-segments and company profiles that define the space.

Public taxonomies like the Global Industry Classification Standard can be a starting point, but you’ll almost always need to reshape them to match how businesses and customers talk about the category in real life.

From there, build a one-pager with typical size and growth ranges, margin characteristics, customer profiles, and common go-to-market motions or channel models to give your team a shared picture of exactly what that “good opportunity” looks like.

Key takeaway: Once you’ve mapped the market terrain and the type of companies you’re chasing, it’s easier to analyze the potential deals that land in your inbox and have meaningful conversations with your targets.

Signal tracking is where your sector investing program switches from a research exercise to a pipeline feeder. The trick is choosing a small set of signals, say six to eight, that tell you whether a company is winning or just making noise.

Hiring in sales or customer success, new partner listings, pricing page changes, a spike in reviews, contract lengths, and newly announced certifications all work well. Signals don’t need to be sophisticated to show how a business is behaving in the wild.

When your team watches the same indicators across a sub-theme, you can recognize outliers early and spot the companies that fit your thesis before anyone else spots them.

Key takeaway: This helps you build the kind of market intelligence that sharpens investment decisions without turning your workflow into a trial-and-error experiment.

A strong sector program needs a proper target universe. Start by pulling together 100 to 300 companies within your sub-theme. That sample size can give you an idea of the complete landscape without overwhelming your team.

For each company, add a short, factual note explaining why it deserves attention; for example, “moving up-market,” “new channel partnership,” “expanding into the UK,” “CS hiring spike,” or “pricing shift.”

Once the list is tagged, assign A, B, and C priorities:

Pro tip: Tags don’t need to be profound. They just need to explain the logic of your analysis quickly so anyone on the team can understand it at a glance.

Outreach only works if it’s clear you’ve done your homework. So skip the vague “we’re exploring your space” teaser and lead outreach to owners and CEOs with something useful instead.

One tight paragraph on what you’re seeing in their niche, like a pricing shift, a channel move, a compliance wrinkle, or an enterprise push picking up momentum, is enough to show you’re paying attention.

Then, give them one concrete thing you could help with in the first 100 days. You don’t have to promise a major transformation, just something real. Maybe that’s tightening pricing, building a partner motion, cleaning up a compliance path, or supporting an enterprise move-up. The more specific, the better.

Pro tip: Whatever value you’re offering, be sure to keep the whole message short. Two or three clean paragraphs, no lengthy deck, no fishing expedition. Executives are more likely to respond when it’s clear you understand their world and can be useful, fast.

Sector investing programs aren’t meant to run on gut feel. You need a few clean metrics that tell you whether all the work is paying off:

These numbers tell you whether you’re tracking themes that resonate or just orbiting a space with little promise of returns. If reply rates are low, that’s usually a signal that your sub-theme is too broad, the angle isn’t sharp enough, or the value story reads like something any firm could send.

Key takeaway: Tightening the thesis, homing in on specific sub-themes, and sharpening insights will help drive more conversions and enable you to build a feedback loop where data nudges you toward repeatable success.

Once you’ve developed the structure of your sector-based program, the tools you use will determine whether it runs smoothly or becomes another abandoned spreadsheet. A private equity CRM centralizes all your firm’s information to help you build a reliable, scalable research program.

Meridian, for example, helps deal teams find opportunities earlier and build conviction faster while keeping the entire firm aligned around the same thesis. Here’s how.

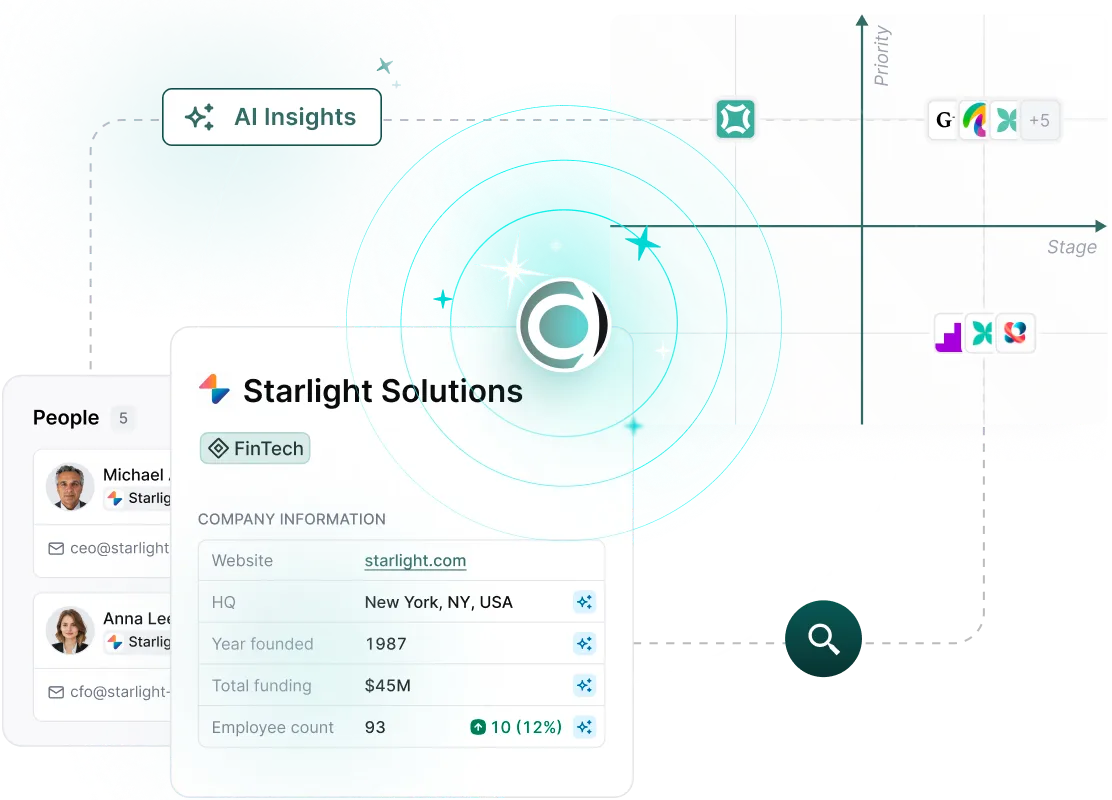

Meridian’s Scout AI agent surfaces and benchmarks new opportunities so you can find winning deals before the competition.

Meridian gives deal and sourcing teams a cleaner, more reliable way to run sector-based investment research. You see the right companies earlier, understand why they matter, and keep your research tied to real signals instead of vague ideas.

The platform sharpens outreach, too. Scout AI helps you contact CEOs and owners with timing and context that actually lands. And when a deal starts moving forward, you can walk into IC with evidence and conviction behind every claim.

The outcome is earlier visibility, more relevant conversations, and a process that keeps working regardless of who’s on your team. Meridian gives you the structure that turns sector-based research work into a powerful sourcing engine.

Discover how Meridian can streamline deal sourcing and enhance your decision-making

Define your thesis and get insights into companies that fit it with AI-powered data enrichment and thematic sourcing features.

Sector investment involves targeting companies within a specific industry or sub-vertical rather than across the whole market. It lets you focus on sectors with strong tailwinds, build thesis-driven deal flow, and track performance under distinct themes rather than based on broad indexes.

Table of Contents

Why the PE on-cycle machine persists, and how both firms and candidates can make better decisions anyway.